UAE E-Invoicing: A Practical Guide for FTA Compliance

Master uae e invoicing requirements and deadlines with a practical, step-by-step guide for seamless FTA compliance.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

The upcoming UAE e-invoicing mandate is more than a paperwork update; it’s a fundamental shift in how businesses report financial transactions. Soon, every VAT-registered company must issue structured digital invoices, a change that will directly reshape daily accounting and compliance workflows. This guide will help you understand the requirements and prepare for a smooth transition.

Understanding the New E-Invoicing Mandate

The United Arab Emirates is modernising its tax system to boost transparency and efficiency. The core of this initiative is the mandatory e-invoice system, requiring all VAT-registered businesses to move away from paper invoices and simple PDFs.

Companies must now create and exchange invoices in a specific, machine-readable digital format. This allows for real-time reporting directly to the Federal Tax Authority (FTA), giving them an immediate and clear view of transactions.

Why Is This Change Happening?

The primary goal is to strengthen VAT UAE compliance and reduce the national tax gap. By automating invoice processing and reporting, the FTA can track transactions, validate VAT calculations, and eliminate errors and fraud more effectively.

While this mandate introduces new processes, it also brings significant long-term advantages for businesses.

- Improved Accuracy: Structured data eliminates manual data entry errors common with paper or PDF invoices.

- Faster Processing: Automation shortens accounts payable and receivable cycles, improving cash flow.

- Enhanced Compliance: Real-time reporting makes it easier to ensure your business consistently meets its FTA obligations.

An e-invoice isn't just a digital file; it's a structured data set that must follow strict technical rules, specifically the PINT AE standard. Each invoice you generate must be perfect before it gets submitted.

Navigating this transition smoothly requires understanding the new rules and preparing your business in advance. As a trusted expert in FTA compliance, Tadqiq is built to guide you. We help businesses validate their invoice data before submission, guaranteeing a smooth and error-free compliance process.

Navigating the Deadlines: Your UAE E-Invoicing Rollout Map

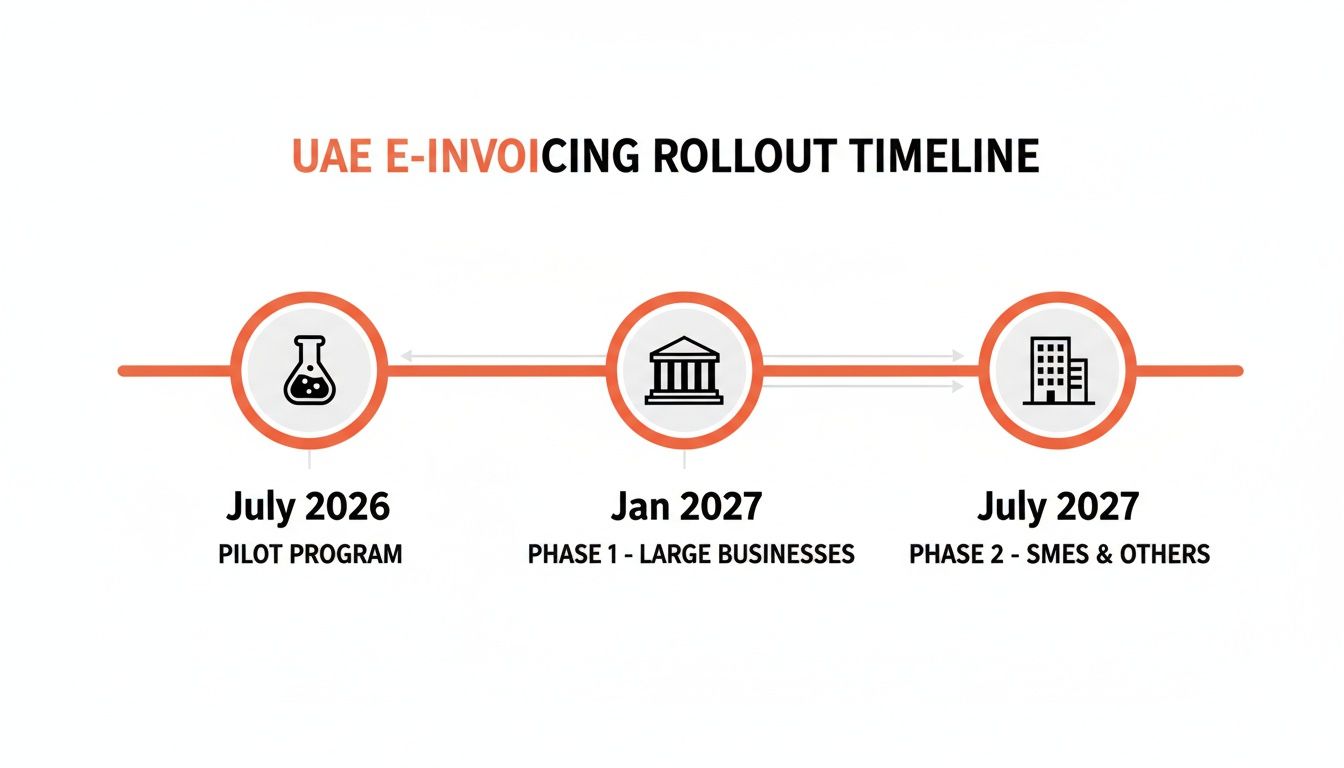

The move to mandatory e-invoicing in the UAE is approaching fast, with clear deadlines and penalties for non-compliance. The Federal Tax Authority (FTA) has planned a phased approach to ensure a smooth transition for all businesses.

Your first step is to identify where your business fits into this schedule. Knowing your go-live date allows you to create a realistic implementation plan, allocate resources, and engage with partners like Accredited Service Providers (ASPs) well ahead of time.

The Phased Rollout Explained

The government has broken down the transition into key stages, starting with a voluntary pilot program before the mandate becomes compulsory for every VAT-registered business. Your company's annual revenue determines your place in the timeline.

The legal basis was set by Ministerial Decisions No. 243 and 244 of 2025, with a voluntary pilot program kicking off on July 1, 2026. This allows a select group of taxpayers to test the system and resolve any issues before the full launch. For more on the legal specifics, Grant Thornton's detailed analysis is an excellent resource.

Here is a breakdown of the key dates.

UAE E-Invoicing Phased Rollout Timeline

A summary of key dates and compliance requirements for different business categories under the UAE's mandatory e-invoicing system.

| Phase | Effective Date | Applicable Businesses | Key Requirement |

|---|---|---|---|

| Pilot | July 1, 2026 | Voluntary for a select Taxpayer Working Group & early adopters | Test and validate the e-invoicing system infrastructure. |

| Phase 1 | January 1, 2027 | Businesses with annual revenue ≥ AED 50 million | Mandatory e-invoicing for all B2B transactions. |

| Phase 2 | July 1, 2027 | Businesses with annual revenue < AED 50 million | E-invoicing mandate extends to SMEs. |

| Phase 3 | October 1, 2027 | Government Entities | All B2G transactions must comply with e-invoicing rules. |

The rollout prioritises larger businesses, followed by smaller companies and government entities, ensuring a stable transition for the entire economy.

Your Revenue Is Your Deadline

Your annual revenue, as reported in your VAT returns, determines your compliance deadline. This figure places your business squarely in either Phase 1 or Phase 2.

You must know your revenue bracket now. Waiting until late 2026 to prepare for a January 2027 deadline is a recipe for stress, errors, and costly non-compliance penalties.

From the start of the pilot phase, you have approximately 18 months to prepare. Use this time to update your accounting software, train your finance team, and ensure your invoice data can be correctly structured for the PINT AE standard.

Understanding the PINT AE Technical Standard

At the core of the UAE's e-invoicing system is a technical standard called PINT AE. Think of it as the official language that all your electronic invoices must speak. If your invoices are not fluent in this language, the Federal Tax Authority's (FTA) systems will not understand them, leading to rejection.

This is not about creating a PDF. It involves producing a file that follows a specific set of rules. PINT AE is the UAE's local version of the global Peppol framework, a trusted international standard for exchanging business documents. Understanding PINT AE is the most critical step for your finance and IT teams.

What Exactly is PINT AE?

PINT AE stands for Peppol International – UAE Extension. It is a rulebook defining how your invoice data must be structured in a machine-readable XML format. An XML file is pure, structured data that computer systems can read, validate, and process instantly.

Imagine sending an international parcel. For it to clear customs, you need the correct address format and customs codes. PINT AE does the same for your invoice data, ensuring it arrives at the FTA’s system in a format it can automatically process.

The timeline below shows how quickly this is happening.

As you can see, the clock is ticking, especially for larger businesses. There is no time to waste in getting your systems and processes ready.

The Two Pillars of PINT AE Validation

To be compliant, your e-invoice file must pass a series of automated technical checks. These are hard rules that determine if your invoice is accepted or rejected.

The validation process has two core components:

- XML Schema Definition (XSD): This is the blueprint of your e-invoice file. It defines the structure and the order of required elements like invoice numbers and line items. If your file's structure doesn't match the XSD, it fails instantly.

- Schematron Business Rules: This is the second, more intelligent layer of checks. While XSD looks at the structure, Schematron rules validate the content. For example, a rule might check that the invoice total correctly sums the line items plus VAT, or that a Tax Registration Number (TRN) has the correct UAE format.

An invoice can have a perfect structure that passes the XSD check but still be rejected for failing a Schematron business rule. This is why pre-submission checks are so critical—they catch both types of errors before the FTA sees them.

Mandatory Fields and UAE-Specific Details

While based on a global model, PINT AE includes rules specific to the VAT UAE system. Your ERP or accounting software must be configured to capture and export this information perfectly every time.

Here are a few non-negotiable fields you must get right:

- Supplier and Buyer Information: Full legal names, addresses, and valid TRNs for both parties in a B2B transaction.

- Invoice Details: A unique invoice number, issue date, and date of supply are mandatory.

- Line Item Breakdown: Each product or service needs its own line with a clear description, quantity, unit price, and the correct VAT rate.

- VAT Calculation: The file must show the correct VAT category code, the taxable amount for each rate, the VAT rate, and the final VAT amount in AED.

An invalid TRN is one of the most common and avoidable reasons for invoice rejection. This is where a pre-processor like Tadqiq becomes invaluable. It is designed to check every one of these UAE-specific rules before you submit, saving your team from the headache of failed submissions.

Understanding the Legal Framework and Compliance Penalties

Adopting the UAE's e-invoicing mandate is a legal requirement, not just a technical one, and non-compliance comes with significant financial penalties. The government has established a firm legal foundation, making it clear that all businesses must take the new rules seriously.

The system is underpinned by specific Cabinet Decisions that give the mandate its legal authority. These decisions outline the rules, timelines, and fines for non-compliance, signalling that the deadlines are firm.

The Legal Authority Behind UAE E-Invoicing

The legal framework for UAE e-invoicing is built on amendments to the existing UAE VAT Law and Regulations. These changes officially introduced the concept of a mandatory electronic invoice, establishing the structured e-invoice as the only legally recognised format for most business transactions.

This was cemented by UAE Cabinet Decision No. 106 of 2025, which laid out administrative penalties for compliance failures. This decision underscores the government's commitment and forces businesses to prioritise system readiness. For a deeper dive into the latest VAT UAE initiatives, you can read this helpful overview on the latest e-invoicing initiatives.

What Happens If You Don't Comply

The penalties are specific and designed to discourage non-compliance. It is crucial for finance managers and business owners to understand these risks, as fines can quickly impact the bottom line.

Here are a few common violations and their penalties:

- Failure to Appoint an ASP: Not appointing an FTA-Accredited Service Provider by your deadline incurs a penalty of AED 5,000 per month.

- Incorrect Invoice Submission: Failing to issue a compliant e-invoice or credit note through the system costs AED 100 per document, capped at AED 5,000 per month.

- System Failure Reporting: If your system goes down, both you and the recipient must notify the FTA. Failure to do so results in a penalty of AED 1,000 per day.

These penalties show that FTA compliance requires timely action, proper procedures, and transparency.

Scope of the Mandate: What's Included and Excluded

Knowing which transactions fall under the mandate is critical. The rules are comprehensive, but there are specific exclusions.

The mandate applies to all persons conducting business in the UAE for all their business-to-business (B2B) and business-to-government (B2G) transactions, including standard-rated and zero-rated supplies.

However, a few transaction types are currently outside the scope:

- Business-to-consumer (B2C) transactions.

- Transactions by government bodies acting in a sovereign capacity.

- Certain exempt or zero-rated financial services.

- Specific airline services.

It is your responsibility to classify every transaction correctly. Protecting your financial data is also a key part of this process, and our commitment to security is detailed in our privacy policy.

Your Step-by-Step Implementation Plan

Knowing the rules is one thing; putting them into practice is another. Preparing for UAE e-invoicing is a project that requires a clear, structured plan. This roadmap will guide you from assessing your current setup to successfully submitting your first compliant invoices.

We'll cover different implementation methods, the role of Accredited Service Providers (ASPs), and how to avoid common technical issues. The goal is to build a process that catches errors before they leave your system.

Assess Your Current Systems and Data Quality

Start by looking internally. Your ERP or accounting software is the heart of your invoicing process, and its capabilities will shape your project. Can your system export the data fields required by the PINT AE standard?

This is about more than software features; it's about data quality. Are your customer records complete and accurate? Do you have validated Tax Registration Numbers (TRNs) for all your B2B clients? Inaccurate or missing data is a primary cause of invoice rejection.

- System Capability: Determine if your software can export data in a structured format like XML, CSV, or Excel.

- Data Mapping: Identify where mandatory PINT AE fields (like buyer TRN and VAT breakdowns) live in your current system.

- Data Cleansing: Start a project to clean your master data now—correct addresses, verify TRNs, and standardise product descriptions.

Choose Your Implementation Path and ASP

Next, decide how you will generate and transmit your e-invoices. The UAE mandate is clear: you must use an FTA-Accredited Service Provider (ASP). An ASP is the official gateway that receives your invoice, checks it for compliance, and forwards it to the tax authorities.

Choosing the right ASP is a critical decision. Look for a provider with a solid reputation, robust security, and clear pricing. Remember the deadlines: large businesses must appoint an ASP by July 31, 2026, and other businesses by March 31, 2027. Missing this deadline incurs a AED 5,000 per month penalty.

There are a few ways to approach implementation:

- Direct ERP Integration: Major ERPs like SAP or Oracle may offer built-in modules that create PINT AE files and connect to an ASP. This is often seamless but can be expensive and complex.

- Middleware Solutions: A popular option where a dedicated tool acts as a bridge between your ERP and your ASP, translating your data into the required PINT AE XML format.

- Manual Upload Portals: Some ASPs offer a web portal for manual uploads. This may work for very low invoice volumes but is not scalable and is prone to human error.

The Critical Role of Pre-Submission Validation

No matter which path you choose, a major risk remains: sending an error-filled invoice to your ASP. When an ASP rejects an e-invoice, your team must find the error, fix it in your source system, and resubmit. This back-and-forth wastes time and risks missing the 14-day issuance deadline.

This is why pre-submission validation is a necessity.

By using a validation tool to check your invoice files against official PINT AE rules before sending them to your ASP, you can catch 100% of format and business rule errors in advance. This ensures your files are perfect on the first attempt.

A pre-validation platform like Tadqiq acts as your quality control checkpoint. It runs the same checks as your ASP and the FTA, flagging any issues in plain English so you can fix them immediately. This transforms FTA compliance from a reactive firefight into a smooth workflow.

Common E-Invoice Rejection Errors and How to Fix Them

Most invoice rejection errors are common and avoidable. Here are some frequent culprits and how to prevent them.

| Error Code (Example) | Common Cause | How to Prevent with Pre-Validation |

|---|---|---|

| BR-AE-10 | The Buyer's TRN is structurally invalid or does not exist. | Tadqiq validates the TRN format and checksum, flagging incorrect numbers before submission. |

| BR-CL-04 | The Invoice total amount does not equal the sum of line items plus taxes. | The platform automatically recalculates all invoice totals to ensure mathematical consistency. |

| BR-S-07 | An incorrect VAT category code is used for a specific product or service. | Tadqiq checks that all tax codes used are valid under the UAE's VAT UAE legislation. |

| BR-CO-26 | The issue date is in an invalid format (e.g., DD/MM/YYYY instead of YYYY-MM-DD). | The platform automatically checks and flags all date fields to ensure they meet the strict ISO 8601 format. |

A robust pre-validation process acts as your safety net, ensuring that by the time an invoice reaches your ASP, it's guaranteed to be compliant.

Your Path to E-Invoicing Success

The shift to mandatory UAE e-invoicing is a significant project, but with the right preparation, it can be a smooth transition. A little foresight can turn this compliance task into a major upgrade for your finance function.

Success comes down to a few core actions. It begins with understanding the phased rollout and knowing your specific deadline. This sets your project timeline and helps you avoid a last-minute scramble.

Getting the Technical and Procedural Details Right

Next, get comfortable with the PINT AE standard. Your financial data must translate perfectly into the required XML format to ensure FTA compliance. Every detail, from your Tax Registration Number to the VAT calculation, must be accurate.

Finally, your secret weapon is pre-submission validation. By checking every e-invoice for errors before sending it to your Accredited Service Provider, you eliminate the painful cycle of rejections and corrections. This step is about getting it right the first time.

Proactive preparation isn't just about avoiding penalties; it's about building a smarter, more accurate, and transparent financial workflow for the long term.

By focusing on these key areas, you're not just meeting a legal mandate—you're improving how your business operates. For more practical tips and updates, visit the Tadqiq blog.

Your E-Invoicing Questions, Answered

As the UAE’s e-invoicing mandate approaches, it's natural for business owners and finance teams to have questions. Here are clear, straightforward answers to some of the most common queries.

What's the Real Difference Between an E-Invoice and a PDF Invoice?

This is a key distinction. While a PDF is electronic, it is not a compliant e-invoice. A PDF is like a digital picture of a document—a human can read it, but a computer cannot reliably extract the data for automation.

A UAE e-invoice, on the other hand, is a structured data file (specifically, an XML file using the PINT AE format). This is pure, organised data that systems at the FTA, your service provider, and your own company can read and process instantly without manual input. This machine-to-machine communication is the foundation of the new system.

Do I Have to Replace My Current Accounting Software?

Probably not. Most modern ERPs and accounting packages can export the raw data needed to create an e-invoice. The challenge lies in converting that data into a perfectly formatted PINT AE compliant XML file.

You will need a bridge to close this gap. This could be an ERP add-on, a service from your Accredited Service Provider (ASP), or a specialised pre-validation tool like Tadqiq. The goal is to establish a reliable process to transform and validate your data before it is sent for FTA compliance.

What Is an Accredited Service Provider, and Do I Have to Use One?

Yes, using an FTA-Accredited Service Provider (ASP) is mandatory for every business. You cannot submit an e-invoice directly to the FTA. An ASP is a government-vetted company that acts as the secure intermediary between your business and the FTA's platform.

The ASP's job is to receive your e-invoice, perform a final validation, and securely pass it to the tax authority. Since the ASP is the official gatekeeper, it is vital that your files are 100% correct before they arrive. Pre-validating your files ensures they pass through your ASP’s checks on the first try.

By verifying your data against the official rules before it ever reaches your ASP, you eliminate the risk of rejection. This proactive step guarantees a smoother, faster, and more reliable compliance process for every transaction.

Are My B2C Invoices Part of This Mandate?

For now, no. The current mandate focuses specifically on Business-to-Business (B2B) and Business-to-Government (B2G) transactions. This provides some breathing room for retailers and other B2C businesses.

However, it is wise to stay informed. In other countries, e-invoicing mandates have often expanded to include B2C transactions in later phases. Keep an eye on future announcements from the FTA. To understand our own policies and obligations, you can review our Terms of Service.

Ready to streamline your e-invoicing? Try Tadqiq today.