A Practical Guide to E-Invoicing in UAE

Master e-invoicing in UAE. Get a clear roadmap on PINT AE standards, FTA compliance, and the 2026 mandate to prepare your business for a smooth transition.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

The way businesses in the UAE handle invoicing is set for a major overhaul, starting from July 2026. This mandatory e-invoicing system is more than just a regulatory update; it's a fundamental shift towards digital efficiency, aiming to streamline B2B transactions and simplify tax compliance for good. For business owners and finance managers, preparing now is key to turning this new requirement into a powerful business advantage.

Understanding the UAE E-Invoicing Mandate

The upcoming UAE e-invoicing mandate, driven by the Federal Tax Authority (FTA), is a complete reimagining of how your business will create, send, and manage invoices. The core goal is to standardise financial data, make VAT UAE compliance seamless, and reduce the administrative burden on businesses of all sizes.

For finance managers and accountants, this means transitioning to a fully digital workflow. The days of manual data entry and paper shuffling are numbered, replaced by a structured, machine-readable format that ensures accuracy and speed.

Key Timelines and Scope

The rollout is phased to help businesses adapt smoothly. It begins with a voluntary pilot program on July 1, 2026, for companies ready to meet the new technical standards. Mandatory implementation will follow, likely starting with larger businesses, such as those with annual turnovers exceeding AED 50 million.

So, who does this apply to?

- Business-to-Business (B2B) transactions.

- Business-to-Government (B2G) transactions.

- Any business registered for Value Added Tax (VAT). For a refresher, read our guide on what is VAT in UAE.

Why This Matters for Your Business

At its heart, the new mandate introduces strict compliance rules. Every e-invoice must be formatted according to the PINT AE standard—a specific technical framework for the UAE. Getting this wrong could lead to operational headaches and potential penalties from the FTA.

However, the upside is significant. Preparing your systems now isn't just about avoiding trouble; it's an opportunity to gain a competitive edge. By embracing this change, you can improve cash flow, eliminate errors, and build a stronger financial foundation for the future.

Demystifying PINT AE: The Language of UAE E-Invoices

At the core of the UAE's e-invoicing system is a standard called PINT AE. Think of it as the official language that every invoice must "speak" to be understood by the Federal Tax Authority (FTA) and other businesses. If your system sends an invoice in a different format, it will be rejected.

This standard ensures that every e-invoice, regardless of the accounting software that created it, presents the same information in the exact same way. This consistency is what enables automated processing and validation, making FTA compliance a seamless part of your workflow.

The Blueprint and The Building Inspector

So, how does PINT AE work? Imagine your invoice data is a building. To ensure it's built correctly, it must pass two technical checks: XSD schemas and Schematron rules.

-

XSD (XML Schema Definition): This is your architectural blueprint. It defines the fundamental structure of your e-invoice—what fields must be included (like buyer name, invoice number), their exact order, and their data type (a date must be a date, a price must be a number). An invoice that fails this check is structurally flawed.

-

Schematron Rules: This is the meticulous building inspector. Schematron rules enforce the specific business logic unique to the UAE. For example, it checks that a Tax Registration Number (TRN) has the correct 15-digit format or that an invoice date complies with FTA regulations.

An invoice can be structurally perfect (passing the XSD check) but still fail the Schematron inspection because it violates a specific UAE business rule. Both checks must be passed for an e-invoice to be compliant.

Mandatory Fields You Cannot Ignore

While the PINT AE standard is detailed, a few fields are absolutely critical for every B2B and B2G e-invoice. An error in any of these will almost certainly cause a validation failure.

Key fields include:

- Correct Tax Registration Numbers (TRN): Both your TRN and your customer's TRN must be valid and correctly formatted.

- Specific Date Formats: Supply, issuance, and payment dates must follow the strict YYYY-MM-DD format.

- Precise Currency Codes: For local transactions, you must use the official "AED" code.

- Emirate Codes: The invoice must state the Emirate where the supply occurred using a standardised code.

- Item Details: Each line item requires a clear description, quantity, unit code (e.g., 'PCE' for piece), unit price, and the correct VAT UAE rate.

How Simple Data Mismatches Cause Big Problems

The automated nature of e-invoicing in UAE means the system has zero tolerance for small errors that a human might overlook. A tiny data mismatch will trigger an instant rejection.

For instance, your ERP might store a customer's TRN with spaces, like "100 123 4567." The PINT AE standard requires a solid string of numbers: "1001234567." If your system doesn't remove those spaces before sending, the invoice will fail. For more details, see our guide on FTA TRN verification.

Turning Compliance Into a Strategic Advantage

While meeting the FTA compliance deadline is a priority, it's crucial to see the bigger picture. The move to UAE e-invoicing is a significant opportunity to make your business run smarter, faster, and more efficiently. Viewing this as just another chore means leaving real value on the table.

This is your chance to replace slow, error-prone manual work with streamlined digital processes, turning a government mandate into a powerful engine for growth.

Slash Errors and Boost Operational Efficiency

Manual data entry is a common source of costly mistakes. A single wrong digit can lead to rejected invoices, delayed payments, and hours of administrative work to fix a simple typo.

The PINT AE standard is designed to eliminate these human errors. Every e-invoice is validated against a strict set of rules before it enters the system, ensuring data is clean from the start. This frees up your finance team from tedious data entry to focus on strategic financial analysis.

Accelerate Payments and Improve Cash Flow

This is where the benefits truly impact your bottom line. Traditional invoicing is slow, and the gap between sending an invoice and receiving payment can strain cash flow. E-invoicing drastically shortens this payment cycle.

Validated invoices are delivered instantly, meaning cash lands in your bank account much faster. This not only boosts liquidity but also strengthens supplier relationships. learn more about the benefits of UAE's digital shift to see how businesses are leveraging this for financial gain.

Simplify Tax Reporting and Audit Readiness

For any business managing VAT UAE, tax season and audits can be a major stressor. E-invoicing creates a perfect, machine-readable digital record of every transaction, making tax compliance transparent and straightforward.

This clean, organised data offers several advantages:

- Simplified VAT Returns: With pre-validated data, compiling VAT returns becomes faster and more accurate. For a refresher, see our guide on how to calculate VAT in the UAE.

- Seamless Audits: If the FTA requests an audit, you can instantly provide a complete and accurate digital trail, demonstrating strong financial controls.

- Improved Accuracy: Automated checks ensure VAT is calculated correctly from the start, reducing the risk of errors that could trigger an audit.

Ultimately, this transition is a chance to build a more resilient, efficient, and financially healthy business.

Preventing Common E-Invoice Validation Failures

An e-invoice is only as good as its data. Even with correct calculations, a validation failure from your Accredited Service Provider (ASP) renders it useless, leading to payment delays and administrative headaches.

This section is your troubleshooting guide for e-invoicing in UAE. By understanding and preventing the most common validation errors, you can ensure a smooth process, maintain compliance, and keep your cash flowing.

Invalid or Incorrectly Formatted TRN

A problem with the Tax Registration Number (TRN) is one of the quickest ways to get an e-invoice rejected. The automated systems for FTA compliance are extremely strict about this detail for both the seller and the buyer.

The two main issues are:

- Invalid TRN: The number doesn’t exist in the FTA’s database, usually due to a typo.

- Incorrect Formatting: The TRN contains spaces or special characters. PINT AE requires a continuous 15-digit number (e.g., "10012345678901").

For a deeper dive, check our complete guide on the TRN Number UAE and its specific formatting rules.

Mismatched Dates and Timelines

The PINT AE framework enforces rigid rules around dates to ensure transactional accuracy and align with VAT UAE regulations. An invoice can be rejected if its dates are illogical, incorrectly formatted, or violate FTA business rules.

Common date-related errors include:

- Incorrect Format: All dates must be in the YYYY-MM-DD format. Entries like "25/12/2026" will fail.

- Illogical Sequencing: The invoice issue date cannot be before the supply date.

- Regulatory Violations: An invoice must typically be issued within 14 days of the supply of goods or services.

Backdating invoices, a practice sometimes overlooked in manual processes, will be caught instantly by the automated validation system. Timely and accurate invoicing is now essential.

Missing or Incorrect Unit and Currency Codes

Absolute precision is also required for line item and currency codes. The PINT AE standard uses internationally recognised codes to ensure data is understood consistently across all systems.

Pay close attention to these two codes:

- Unit of Measure Codes: Every line item needs a valid UN/CEFACT code. For example, use "PCE" for "piece," not a generic term like "unit."

- Currency Code: For all domestic UAE transactions, the currency must be defined with the official ISO 4217 code: "AED."

Ensuring your ERP and product databases use these standardised codes is a critical step in preparing for e-invoicing in UAE. Pre-submission validation tools like Tadqiq excel at catching these very errors before they cause a rejection.

Common PINT AE Validation Errors and Solutions

| Error Code | Plain English Explanation | Example of an Error | How to Fix It |

|---|---|---|---|

| BR-AE-03 | Buyer's TRN is missing or in the wrong format. | TRN: 100-1234-5678-901 | Remove all spaces and hyphens. The TRN must be a continuous 15-digit number, like 10012345678901. |

| BR-CO-09 | The invoice issue date is in the future. | IssueDate: 2027-01-15 (when today is 2026-12-20) | The invoice issue date cannot be later than the current date. Adjust it to the correct, present date. |

| BR-CL-14 | A line item is missing its unit of measure code. | cac:InvoicedQuantity field is empty. | You must provide a valid UN/CEFACT code for each item (e.g., PCE for piece, KGM for kilogram). |

| BR-S-08 | The VAT calculation for a line item is incorrect. | Item Price: 100, VAT: 5, but Line Total: 104 | Recalculate the VAT. The line total must equal the item's net amount plus the correctly calculated VAT amount. |

| BR-AE-DEC-13 | A value has more than two decimal places. | PriceAmount: 150.755 | Round all financial amounts to two decimal places as required by the standard (e.g., 150.76). |

By familiarising your team with these common errors, you can build a proactive validation step into your workflow.

Mapping Your E-Invoicing Workflow

How does an invoice in your accounting system become a compliant e-invoice registered with the authorities? Understanding this journey is key to success. It's a structured workflow designed to ensure data is perfect before it becomes official.

The UAE uses a decentralised 'five-corner model' to ensure your business, your customer, and the tax authority can communicate securely and in a standardised way, with specialist providers acting as intermediaries.

The Five Corners of UAE E-Invoicing

Think of the e-invoicing journey as a secure relay race with five participants:

- Your Business (The Seller): You create an invoice in your ERP or accounting software like Zoho, Oracle, or Wafeq.

- Your Accredited Service Provider (ASP): You send this invoice data to your chosen ASP.

- The Central Network (Peppol): Your ASP converts your data into the PINT AE format and sends it into the Peppol network, which acts as a smart postal service.

- The Recipient's ASP: The e-invoice arrives at your customer’s ASP.

- Your Customer (The Buyer): Their ASP delivers the validated e-invoice directly into their accounting system.

This model ensures security and seamless interoperability for all B2B and B2G transactions in the country.

The Hidden Step: Data Export and Preparation

Getting data out of your ERP is just the first step. Your accounting software holds the right information but almost certainly doesn't store it in the exact XML structure that the PINT AE standard demands.

You can't just export a standard report. The raw data must be cleaned, restructured, and converted into the precise PINT AE XML format. This transformation is the most critical and error-prone step in the entire workflow.

The Quality Gate: Pre-Submission Validation

This is where a pre-validation platform like Tadqiq becomes your secret weapon. Instead of sending data directly to your ASP and hoping for the best, you add a quality control step. Think of it as a safety net that catches issues before official submission.

Here’s how it fits into your process:

- Export: Pull invoice data from your ERP in a simple format like CSV or Excel.

- Validate: Upload the file to Tadqiq. The platform instantly runs the same checks your ASP will.

- Correct: The tool flags every mistake in plain English and tells you exactly how to fix it.

- Submit: Generate a perfectly structured, 100% compliant XML file, ready to send to your ASP with confidence.

This proactive approach saves your team time, prevents rejections, and ensures you get paid faster, making your entire e-invoicing in UAE process smooth and reliable.

Your Next Steps Toward E-Invoicing Readiness

Preparing for mandatory e-invoicing is a significant project, but it’s manageable if you start now. Waiting until the last minute will only create unnecessary risk and stress.

A head start gives you time to evaluate your systems, train your staff, and implement a solid pre-validation process. This isn't just about FTA compliance; it's about unlocking the efficiencies and cost savings of a truly digital invoicing system. If your business is new to tax obligations, our guide on how to register for VAT in the UAE is a great place to begin.

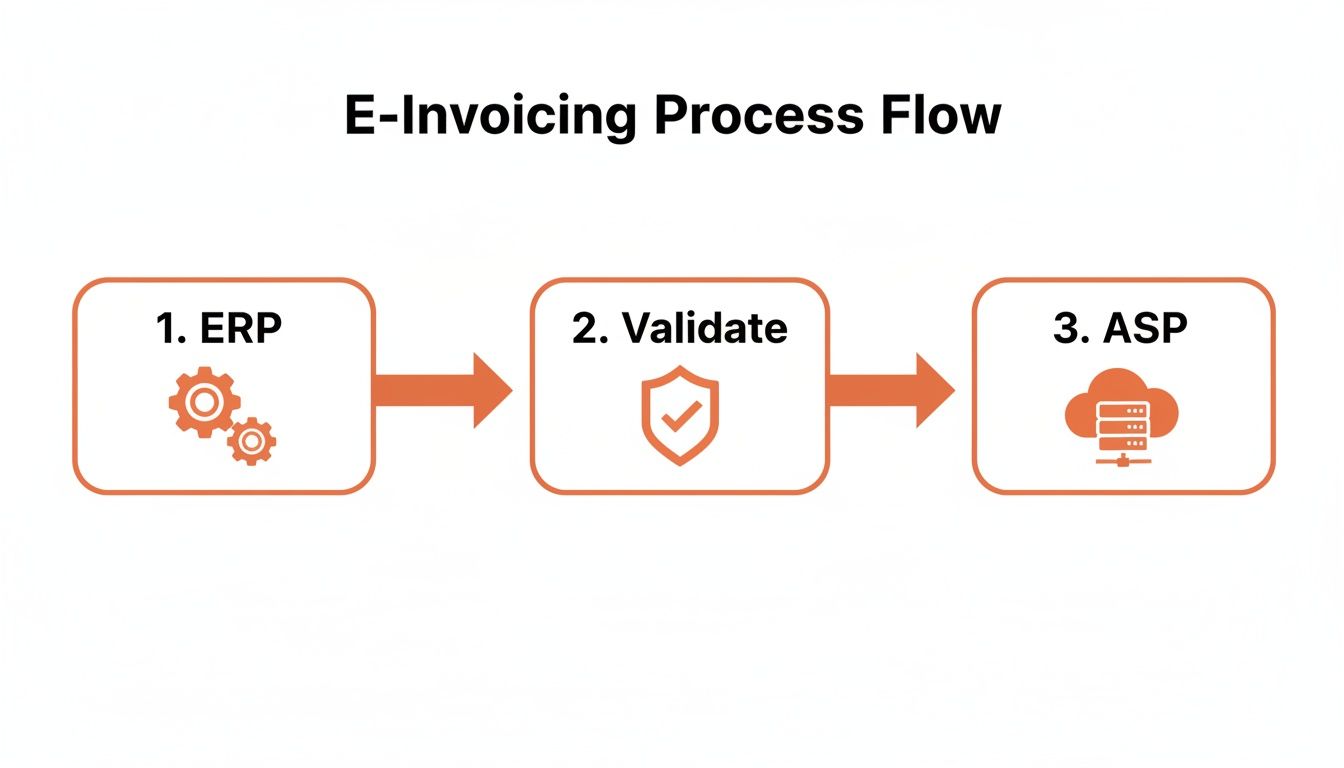

Think of the process in three simple steps: your ERP generates the data, a validation check is performed, and then it's sent to your ASP.

The middle validation step is the secret sauce. It acts as a crucial quality gate, catching errors before they cause a rejection from the tax authority's system. By building your readiness plan now, your business can step into this new phase with total confidence.

The Readiness Checklist

Here's what your business should be focusing on right now:

- System Assessment: Can your current ERP export all the required invoice data fields?

- Team Training: Does your finance team understand the new PINT AE data requirements?

- Process Implementation: Have you designed a workflow that includes pre-submission validation?

Tackling these points turns a regulatory hurdle into a genuine operational advantage.

Your Top UAE E-Invoicing Questions, Answered

With the e-invoicing in UAE mandate on the horizon, we understand there are many questions. Our goal is to provide clear, straightforward answers to help you prepare your business with confidence.

Is E-Invoicing Mandatory for All UAE Businesses?

The rollout is phased. It begins with a voluntary pilot on July 1, 2026. After that, the mandate goes live for larger businesses (annual turnover > AED 50 million). All other VAT-registered businesses are expected to be included by 2027. The initial focus is on B2B and B2G transactions.

What Should I Look for in an Accredited Service Provider?

Choosing the right Accredited Service Provider (ASP) is a critical decision for FTA compliance.

Look for these key features:

- Official FTA Accreditation: This is non-negotiable. Ensure the provider is on the Ministry of Finance's approved list.

- System Integration: The ASP’s platform should connect easily with your current ERP or accounting software.

- Security and Reliability: The provider must have robust security measures to protect your sensitive financial data.

- Support Model: You need clear, helpful feedback when an e-invoice is rejected, not cryptic error codes.

How Is PINT AE Different From Other E-Invoicing Standards?

PINT AE is the UAE's specific version of the global Peppol framework. While built on the same technical foundation, it includes business rules unique to the UAE, such as:

- Validation of the 15-digit UAE Tax Registration Number (TRN) format.

- Enforcement of invoice issuance timelines (e.g., within 14 days of supply).

- Requirement of specific codes for AED currency and each of the Emirates.

You cannot use an e-invoicing standard from another region and expect it to work for the UAE.

Will I Need to Replace My Current ERP System?

For most businesses, the answer is no. You likely won't need to replace your current ERP, as long as it can export the data fields required by the PINT AE standard.

A more practical approach is to use a middleware tool to bridge the gap:

- Export invoice data from your existing software (e.g., in a CSV file).

- Use a validation tool like Tadqiq to check, fix, and convert the data into the correct XML format.

- Send the compliant file to your ASP for submission.

This strategy ensures 100% FTA compliance without a disruptive and costly system migration.

Ready to streamline your e-invoicing? Try Tadqiq today.