UAE Credit Note Format: Your Guide to FTA E-Invoicing Compliance

Discover the format of a credit note for UAE e-invoicing, with essential fields, compliance tips, and practical examples to streamline your process.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

Issuing a credit note in the UAE might seem like a simple task, but getting the format wrong can cause serious headaches with the Federal Tax Authority (FTA). With the national UAE e-invoicing mandate approaching, mastering the correct format of a credit note isn't just good business—it’s a necessity for every VAT-registered company to ensure FTA compliance. This guide provides a clear blueprint for creating perfectly formatted credit notes that meet the new digital standards.

Why the Correct Credit Note Format is Critical for Compliance

A credit note that fails to meet FTA standards can immediately impact your bottom line. Incorrect formats can lead to rejected VAT UAE claims, frustrating reconciliation problems, and potential penalties during an audit. As the country transitions to mandatory e-invoicing, every document will be validated by an automated system, magnifying these risks significantly.

By understanding the required details, you can ensure every credit note you issue is compliant. This proactive approach helps your business avoid common and costly problems, including:

- Rejected Submissions: An incorrectly formatted credit note will be automatically rejected by the system, delaying important VAT adjustments.

- Audit Trail Gaps: A correctly structured credit note creates a clear and unbreakable link to the original tax invoice, which is non-negotiable for audit purposes.

- Operational Delays: Time spent fixing formatting errors is time not spent on core business activities, disrupting productivity and cash flow.

Mastering the correct format today ensures a seamless transition to the new e-invoicing system, saving you time and preventing expensive mistakes.

The Anatomy of a UAE Tax Credit Note: FTA Fundamentals

Before diving into e-invoicing specifics, let's cover the basics. The requirements for a tax credit note were established by the UAE's Value Added Tax (VAT) law in 2018. These Federal Tax Authority (FTA) rules are the foundation for both paper-based and electronic documents.

Think of the traditional requirements as the blueprint. The new PINT AE e-invoicing standard is a modern, digital way of reading that same blueprint—it doesn't change the fundamental structure. Mastering these core requirements now will make creating a compliant e-invoice much simpler.

What the FTA Absolutely Requires

The FTA is explicit about what makes a tax credit note legally valid. Article 60 of the VAT Executive Regulations states that a credit note carries the same legal weight as a tax invoice when adjusting your output tax. This means it must contain specific details to create a clear, unbreakable audit trail.

This isn't just good practice; it's the law. Below is a breakdown of the mandatory fields for any tax credit note issued by a VAT-registered business in the UAE.

Mandatory Fields on a UAE Tax Credit Note (FTA Requirements)

| Field | Description | Why It Is Important for FTA Compliance |

|---|---|---|

| Document Title | The words "Tax Credit Note" must be displayed clearly. | Instantly identifies the document's legal purpose, preventing confusion with a standard invoice. |

| Supplier Details | Your business's full legal name, address, and Tax Registration Number (TRN). | Identifies the issuer for VAT purposes and proves you are registered to collect and remit tax. |

| Recipient Details | The customer's full legal name, address, and TRN (if they are also VAT-registered). | Correctly attributes the VAT adjustment to the right customer, which is crucial for their input tax records. |

| Unique Identifier | A sequential, unique number that identifies this specific credit note. | Ensures every document is traceable and prevents duplicate entries or fraudulent claims. |

| Date of Issue | The date the credit note was officially created. | Establishes the exact tax period in which the VAT adjustment should be reported. |

Getting these details right is the bare minimum for creating a document that will stand up to FTA scrutiny.

Linking to the Original Invoice

A credit note never exists in isolation. Its purpose is to amend a past transaction, so it must create an undeniable link back to the original sales invoice.

To forge this critical link, your credit note must include:

- Original Invoice Number: The unique identifier of the tax invoice being adjusted.

- Reason for Credit: A clear explanation, such as "Return of damaged goods" or "Correction of pricing error."

- Value Adjustments: The total value of the goods or services being credited and the exact amount of VAT being reversed, stated clearly in AED.

Your Tax Registration Number (TRN) is your unique identity in the UAE's tax system, and its accuracy is paramount. An incorrect TRN on a credit note is one of the fastest ways to have it rejected.

How E-Invoicing Changes the Credit Note Format

The upcoming UAE e-invoicing mandate will transform the credit note from a familiar PDF into a structured, machine-readable file. This is a fundamental shift from manual processing to automated digital validation, and getting the format of a credit note right is crucial for FTA compliance.

At the heart of this change is a new technical standard called PINT AE. If your current credit note is like a handwritten letter, the new PINT AE version is a standardized digital form where every piece of information has a specific, pre-defined box. This allows for instant, automated validation by the FTA's systems.

From PDF to XML: The New Digital Language

The new format for all electronic invoices and credit notes is an XML (eXtensible Markup Language) file. XML is a text-based format that uses tags to structure data, acting like labels that tell computer systems exactly what each piece of information is.

For example, where a PDF might show "Original Invoice: INV-2024-00123," the XML file uses specific tags like <cac:BillingReference><cbc:ID>INV-2024-00123</cbc:ID></cac:BillingReference>. This rigid structure enables automation, allowing the FTA's systems to read and validate every detail on your credit note in seconds.

The image below shows how a familiar PDF layout is converted into its structured PINT AE XML counterpart.

As you can see, the XML ensures every data point—from the TRN to the VAT amount—is clearly defined for automated processing.

Why This Shift Is Happening

This move to a structured format is a cornerstone of the UAE's national e-invoicing initiative. The transition from free-form documents to structured XML files conforming to PINT AE (Peppol International – UAE Extension) is reshaping business processes ahead of the phased rollout beginning in 2026. Learn more in our complete guide to UAE e-invoicing.

The new system is designed to achieve key goals for the UAE's tax administration:

- Increased Accuracy: Automated validation virtually eliminates human errors like typos in invoice references or VAT miscalculations.

- Faster Processing: Digital systems can process thousands of documents in the time it takes a person to check one, speeding up VAT reporting and refunds.

- Enhanced Transparency: Structured data gives the FTA a clearer, real-time view of economic activity, helping ensure fair and consistent tax collection.

For businesses, this means the focus must shift from document design to ensuring the underlying data is perfectly structured according to PINT AE specifications. The switch to an XML-based e-invoice format for credit notes moves from ambiguity to absolute clarity, making pre-validation an essential step for staying compliant.

A Practical Breakdown of PINT AE Credit Note Fields

Let's move from theory to practice and dissect the specific PINT AE fields that make up a compliant electronic credit note. Understanding these data points is essential, as every piece of information has a designated place in the new UAE e-invoicing world. Get the structure right, and your credit note will pass automated validation smoothly.

Think of your accounting software as the source of raw data—quantities, prices, tax rates. The PINT AE standard is the recipe that dictates exactly how that data must be combined into a structured XML file. If a single element is out of place, the submission gets rejected.

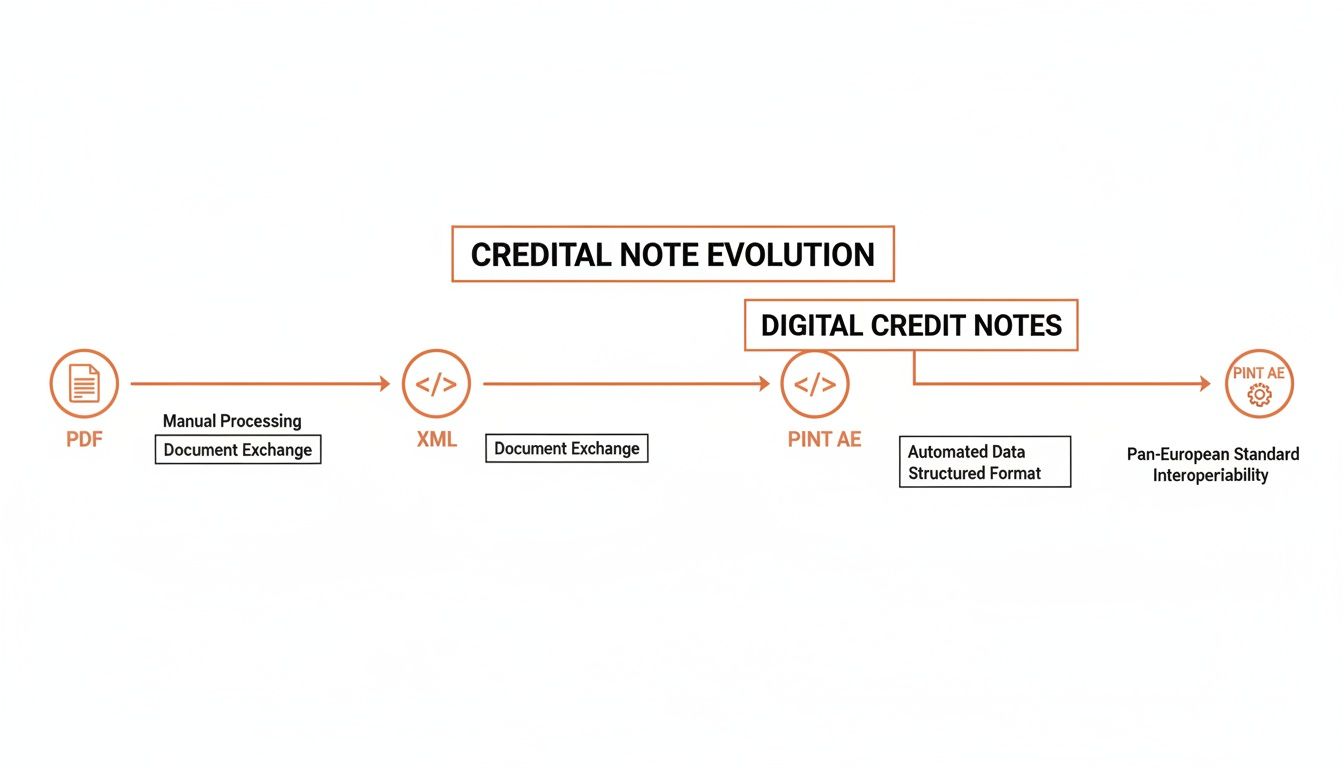

This diagram illustrates the evolution from simple documents to the structured, machine-readable PINT AE standard.

This shift is about moving from human-readable PDFs to a system where data accuracy and structure are paramount for automated compliance.

Document-Level Information

The PINT AE format requires specific details at the top of the file to identify the document. These fields provide the essential context for the transaction and are subject to strict rules.

Key document-level fields include:

- Profile ID: A technical flag indicating the document conforms to the PINT AE standard.

- Credit Note Number (ID): Your unique, sequential identifier for the credit note. It cannot be repeated.

- Issue Date: The date the credit note is generated, which must follow the

YYYY-MM-DDformat. - Document Currency Code: For any UAE business, this field must be "AED".

Supplier and Customer Details

You must clearly identify the seller and buyer with highly structured information, including separate tags for name, address lines, and city. The most critical fields here are the Tax Registration Numbers (TRNs).

Crucial for Compliance: The

AccountingSupplierPartyandAccountingCustomerPartysections must contain the correct, validated TRNs for both your business and your customer (if VAT-registered). An invalid or mismatched TRN is a primary reason for rejection.

Line-Item Accuracy

This is where precision is non-negotiable. Each product or service being credited needs its own dedicated line item in the XML file, with a complete set of data points.

Every line item requires:

- Credited Quantity: The number of units being credited, with a specific unit code (e.g.,

PCEfor piece). - Net Amount: The total price for that line before VAT.

- VAT Category Code: This code tells the system which VAT rate to apply (e.g., 'S' for standard-rated items).

- VAT Rate: This must be specified as '5' for the standard 5% rate.

Accurate tax calculation on each line is fundamental. For a deeper dive, check out our guide on how to calculate VAT in the UAE. Even a tiny rounding error can cause a validation failure, which is where a pre-validation tool like Tadqiq can prevent headaches by catching errors before submission.

Common Credit Note Validation Errors and How to Fix Them

Under the new UAE e-invoicing system, every credit note undergoes instant, automated validation. There is no grace period; if there's a mistake in the format of a credit note, the system rejects it immediately. Proactive troubleshooting is essential for smooth business operations.

Let's review the most common validation errors to prevent them. Most issues arise from simple data entry mistakes that are easy to miss but will halt your submission process. Spotting and fixing these problems before submission saves time and avoids VAT adjustment delays.

Invalid or Mismatched TRN

An incorrect Tax Registration Number (TRN) is a frequent and critical error. The e-invoicing system cross-references both your TRN and your customer's TRN against the FTA's official database upon submission.

An invalid TRN can result from:

- A simple typo in the 15-digit number.

- Using an old TRN for a customer who has since de-registered.

- Accidentally pasting your own TRN into the customer's field.

The Fix: Make it a habit to validate both TRNs before generating the credit note. Manual checks are a start, but automated validation is far more reliable. For more on this topic, learn more about FTA TRN verification and its impact on compliance.

Incorrect Reference to the Original Invoice

A credit note is useless without a clear link to the original tax invoice it corrects. The PINT AE standard has a specific field for this reference. If the invoice number is incorrect or doesn't exist, your credit note will be rejected. This error breaks the audit trail, as the system cannot connect the credit to a previous debit.

Key Insight: The original invoice number is a unique key. If it is wrong or missing, the submission will fail.

Mismatched Line-Item and Document Totals

This classic accounting headache becomes an immediate rejection in an automated system. The sum of all individual line items—net amounts, VAT amounts, and gross totals—must add up exactly to the overall document totals listed in the XML file's summary section. Even a one-fil difference due to rounding will cause a validation failure.

The Fix: Ensure your ERP or accounting software handles rounding consistently. Before submission, confirm that the sum of the parts equals the whole, down to the last decimal.

The Tadqiq dashboard screenshot below shows how a pre-validation tool flags these specific errors before you send the file. By pinpointing the exact problem, tools like this turn a frustrating rejection into a quick fix.

Using Incorrect Codes or Formats

The PINT AE standard relies on a strict set of codes and formats. Using the wrong one is like speaking a language the system doesn't understand.

Common mistakes include:

- Currency Code: Using "USD" instead of the mandatory "AED".

- Date Format: Using

DD/MM/YYYYinstead of the requiredYYYY-MM-DD. - VAT Category Code: Using a generic tax code instead of the specific PINT AE code, like 'S' for the standard rate.

- Unit of Measure Code: Typing "pcs" instead of the official UN/CEFACT code "PCE".

These may seem like minor details, but they are deal-breakers for the validation engine. The most effective way to eliminate these errors is to use a pre-validation platform. A tool like Tadqiq acts as a safety net, running the same checks as the official system and flagging every mistake in plain English before you submit.

Your Checklist for a Compliant UAE Credit Note

Use this checklist as a pre-flight check before sending a credit note into the e-invoicing system. This simple workflow helps ensure every document passes validation on the first attempt by bringing together all critical legal and technical details.

Making these steps a habit provides peace of mind that every submission meets the precise format of a credit note needed for FTA compliance, preventing rejections and streamlining workflows.

Document Header and Party Details

Get the basics right first, as a simple typo here can cause an instant rejection.

- Document Title and Type: Is the document clearly labelled "Tax Credit Note"? Does the PINT AE file use the correct document type code?

- Unique ID and Date: Does the credit note have a unique, sequential number? Is the issue date formatted as

YYYY-MM-DD? - Supplier Information: Are your company's full legal name, address, and 15-digit TRN correct?

- Customer Information: Have you verified your customer’s full legal name, address, and TRN?

Transaction and Financial Data

Precision is everything here. Every figure and reference must be accurate for the document to pass automated checks.

A credit note is only as good as its link to the original sale. An incorrect reference to the original tax invoice will result in an outright rejection.

Financial Checklist:

- Original Invoice Reference: Have you included the correct number of the original tax e-invoice?

- Reason for Issuance: Is the reason for the credit clear (e.g., "Return of goods," "Pricing adjustment")?

- Line-Item Accuracy: Are the quantity, unit price, and net amount for each credited item calculated correctly?

- VAT Calculation: Has the VAT UAE rate (e.g., 5%) been applied correctly to each line? Brush up on the basics with our guide on what is VAT in the UAE.

- Total Amounts Verification: Do the totals match? The sum of all line-item amounts must perfectly match the grand totals.

- Currency Code: Is the currency set to "AED" throughout?

Building this checklist into your standard process is the surest way to catch common errors that cause submission failures.

Conclusion: Get Your Credit Notes Right, Every Time

Mastering the format of a credit note is no longer just good bookkeeping; it's essential for staying compliant with the FTA in the UAE. From basic legal details to the specific structure of a PINT AE XML file, every element plays a crucial role in your submission's success.

A single formatting mistake can lead to a rejected e-invoice, causing delays in processing VAT adjustments and creating extra work for your finance team. The smart approach is to validate your credit note data against official rules before submission. A tool like Tadqiq provides the peace of mind that every file is compliant and ready to pass on the first attempt.

With mandatory e-invoicing, there is no room for error. Validating files before submission shifts the process from fixing problems to ensuring every credit note is perfect from the start.

Frequently Asked Questions

As the UAE e-invoicing system rolls out, it's natural to have questions. Here are answers to some of the most common ones about credit note compliance.

Do I need to issue an e-credit note for B2C transactions?

Yes. The upcoming mandate is expected to cover all transactions, including business-to-consumer (B2C) sales. If a customer returns an item and you need to adjust a previously issued tax invoice, that adjustment must be recorded with an electronic credit note in the official PINT AE format to keep your VAT UAE records accurate.

What happens if I reference the wrong invoice on a credit note?

Linking a credit note to the wrong original invoice is a critical error that will lead to immediate rejection by the system. The PINT AE format is designed to create a verifiable link to the original e-invoice. An incorrect reference breaks this audit trail, making the credit note invalid until you fix the error and resubmit.

The connection between a credit note and its original invoice is foundational for FTA compliance. An incorrect reference invalidates the credit note.

Can I issue one credit note for multiple invoices?

While it may seem efficient, the best practice is to maintain a one-to-one relationship: one credit note for each tax invoice you are correcting. This approach keeps your audit trail clean and simple for both your team and your customer's. Bundling corrections for multiple invoices into a single credit note complicates the XML data and significantly increases the risk of rejection.

Ready to streamline your e-invoicing? Try Tadqiq today.