A Practical Guide to Your ICV Certificate Dubai

Unlock business growth with our guide to the ICV certificate Dubai. Learn the scoring, document prep, and process to secure your UAE certification.

Posted by

Related Reading

Small Business Relief UAE Corporate Tax: A Practical Guide for SMEs

Learn how small business relief uae corporate tax works, eligibility, the AED 3 million threshold, and how to claim it for your UAE business.

Read →

A Practical Guide to HS Code Dubai Customs

Master the hs code dubai customs 12-digit system. Our guide helps UAE finance managers avoid costly errors and ensure seamless import compliance.

Read →

Your Guide to the HS Code UAE System for Tax and Customs

Master the HS Code UAE system. Learn to find and use the correct 12-digit codes for customs, VAT, and FTA e-invoicing compliance.

Read →

If you’re doing business in Dubai, the In-Country Value (ICV) certificate is something you absolutely need to have on your radar. Put simply, it’s a document that officially measures how much your company contributes to the UAE's economy.

For any business serious about landing government or semi-government contracts, holding a valid ICV certificate is no longer optional—it's mandatory. This makes it one of the most critical assets for winning bids and staying competitive.

Why an ICV Certificate Is a Game-Changer

You've probably noticed the shift in how major deals are won here. Government bodies and large corporations are now heavily favouring suppliers with strong ICV scores. This isn't just about ticking a box; it’s a national strategy to channel spending back into the local economy and build a more resilient, self-sufficient market.

So, what does this mean for your business? A massive opportunity. When you're up against a competitor for a high-value contract, a higher ICV score can be the very thing that seals the deal. It sends a clear message: you're invested in the UAE's economic vision, making you a partner of choice.

The Strategic Value for Your Business

Getting certified unlocks real, tangible benefits that go far beyond just meeting a requirement. It genuinely sharpens your competitive edge and boosts your market standing.

Here’s what you stand to gain:

- Priority in Tenders: When bids are being evaluated, companies with an ICV certificate get a clear advantage.

- Enhanced Reputation: It’s a powerful statement about your commitment to the local economy, which builds incredible trust with partners and clients.

- Access to New Opportunities: Many major projects are now ring-fenced for ICV-certified suppliers only. Without it, you can't even get in the room.

Aligning ICV with Broader Compliance

One of the best side-effects of the ICV process is how it forces you to get your house in order. To prepare for the audit, you have to dig deep into your financial and operational data—everything from supplier invoices to employee payroll.

This naturally tightens up your internal controls and financial discipline. It also syncs up perfectly with other regulatory duties, like keeping precise records for tax. The kind of detailed bookkeeping needed for ICV is very similar to what’s required for other obligations. For a closer look at those principles, our guide on what is VAT in UAE is a great resource.

Ultimately, the key is to see ICV certification not as a chore, but as a strategic goal. When your finance team approaches it this way, it becomes a powerful tool for driving real business value.

Decoding the ICV Score and How to Boost Your Contribution

Before your team even thinks about starting the ICV application, it’s crucial to get a handle on what actually drives the score. Don't think of it as a simple pass-or-fail test. Instead, see the ICV score as a direct reflection of your company's positive footprint on the UAE economy. A higher score tells government and semi-government bodies that you're deeply invested here, making you a much more attractive partner.

The calculation itself is a weighted formula that looks at several key parts of your business. It's a holistic assessment, so you can't just excel in one area and hope for a top score. Everything from your capital investments to your payroll has a role to play.

The impact of the National In-Country Value (ICV) Program on the local economy has been massive. By the first half of 2024, major national companies had channelled an incredible AED 48 billion into local procurement and services. This isn't just a box-ticking exercise; it's a serious commitment driven by the Ministry of Industry and Advanced Technology (MoIAT). You can dig deeper into how local procurement trends are shaping the ICV process.

The Core Pillars of the ICV Formula

To genuinely improve your score, you first have to understand the building blocks of the formula. Each pillar represents a different way your business contributes value right here in the UAE.

A great way to visualise this is to break down the main components that contribute to your final ICV score. The table below outlines each pillar and gives you a tangible idea of how you can start making improvements.

Key Pillars of the ICV Scoring Formula

| Scoring Pillar | Description | Example Action for Improvement |

|---|---|---|

| Goods Manufactured | For manufacturers, this measures the cost of goods produced locally, factoring in local materials and labour. | Switch to a UAE-based supplier for a key raw material used in your production line. |

| Third-Party Spend | A big one for most businesses. This is your total spend with other UAE suppliers who also hold an ICV certificate. | Audit your vendor list and prioritise shifting contracts to ICV-certified local providers for services like IT or marketing. |

| Investment | This reflects your long-term commitment by assessing the net book value of your physical assets within the UAE. | Purchase new machinery or office equipment for your Dubai office instead of leasing it from an overseas entity. |

| Emiratisation | Your score gets a major boost based on the salaries and benefits paid to your Emirati employees. | Launch a graduate training programme specifically aimed at hiring and developing young Emirati talent. |

| Expatriate Contribution | Costs associated with your non-Emirati workforce (salaries, benefits) are also factored in, but weighted differently. | Invest in accredited training and professional development courses for your expatriate staff through local institutes. |

| Revenue from Exports | Revenue earned from outside the UAE also counts. It shows your local operations are bringing foreign cash into the economy. | Develop a new export strategy to enter markets in neighbouring GCC countries, managed from your UAE base. |

Thinking through each of these pillars helps you pinpoint exactly where your company can make the most impactful changes before you submit your financials.

The Real Secret: A high ICV score isn’t just about spending money in the UAE. It's about spending it smartly—with other ICV-certified partners and by investing in local assets and people. This is what creates that powerful ripple effect across the economy.

A Practical Scenario: Shifting a Procurement Strategy

Let's walk through a real-world example. Picture a mid-sized consulting firm in Dubai Media City. They get their first ICV report back, and the score is just okay—dragged down mostly by their third-party spend.

When their finance manager digs into the numbers, they realise the company uses an international vendor for all its IT support and hardware, paying them in US dollars. It’s a huge operational cost that’s contributing nothing to their ICV score.

To fix this, the manager finds a local, ICV-certified IT services company based in Al Quoz. They make a strategic decision to switch all their procurement for new laptops and ongoing tech support to this new supplier.

The impact on their next ICV calculation is immediate and significant:

- The full amount spent with the new local IT supplier now positively contributes to their Third-Party Spend pillar.

- Because the new supplier is also ICV-certified, the value of that spending is maximised within the formula.

This single, targeted shift in procurement could easily bump their overall score by several percentage points. Suddenly, their bids for government projects look a whole lot more competitive. This is exactly the kind of proactive thinking that accounting and finance teams need to bring to the table.

Your Ultimate Document Checklist for a Smooth Application

A disorganised application is the fastest way to get your submission delayed or flat-out rejected. When you're going for ICV certification, you have to think like a project manager. Every single document is a critical piece of the puzzle. It’s not just about collecting papers; each one needs to be accurate, complete, and contribute to a consistent story about your company's value to the UAE economy.

Think of this checklist as your game plan. It’s for your finance and HR teams, explaining the 'why' behind each document from an auditor's perspective. Getting this right upfront will save you countless hours and the frustrating back-and-forth that can stall your application for an ICV certificate in Dubai.

Core Financial Documents

This is the absolute foundation of your ICV submission. Certifying bodies will put these documents under a microscope to make sure the numbers you claim in the ICV template are real and verifiable. Any inconsistency here is an immediate red flag.

First and foremost, you need your audited financial statements. These aren't optional. They must be prepared according to International Financial Reporting Standards (IFRS), cover your most recent financial year, and be signed off by a licensed UAE auditor. This is the source of truth for your revenue, costs, and assets.

Beyond the main report, make sure you have these ready:

- Trial Balance: The numbers in your trial balance must tie out perfectly with your signed financial statements. Auditors will cross-reference these, and any discrepancy will be questioned.

- Detailed Cost Breakdowns: You’ll need to provide a granular look at your cost of goods sold and operating expenses. This is how you’ll properly classify what you spent locally versus internationally.

- Fixed Asset Register: This is a must-have. The register needs to list every company asset located in the UAE, complete with purchase dates and their net book value. This directly feeds into the 'Investment' part of your ICV score.

Human Resources and Payroll Data

The ICV formula gives a lot of weight to your team, especially your Emiratisation efforts. Auditors need cold, hard proof of your payroll expenses and employee demographics. If your HR records are vague, your score will suffer—it's as simple as that.

The single most important document here is your complete Wage Protection System (WPS) record for the entire financial year. I’ve seen auditors spend most of their time here, meticulously checking WPS reports against the payroll figures in the financial statements.

An auditor's primary goal is verification. If your WPS records show a total payroll of AED 5 million, but your audited financials declare AED 5.5 million, you must have a clear reconciliation ready to explain the difference (e.g., end-of-service benefits paid outside WPS).

You'll also need to pull together these essential HR files:

- Employee List: A master sheet with every employee's details: nationality, visa sponsor, job title, and total annual salary.

- Emirati Staff Documentation: For every Emirati on your team, get their passport, Emirates ID, and labour contract ready. This is critical for proving the high-value Emiratisation component of your score.

- Staff Accommodation & Transport Costs: If your company covers these expenses, have detailed breakdowns and proof of payment handy. These costs can often be included in your ICV calculation.

Operational and Supplier Records

This is where you prove your company's day-to-day footprint in the UAE. It’s how you show how much you're spending with local, ICV-certified suppliers—a powerful lever for boosting your score.

Start by creating a complete list of your suppliers for the financial year. For each one, detail the total amount spent in AED. Crucially, you must also note whether they have a valid ICV certificate of their own, as this changes how that spend is weighted in your favour.

A few other operational records are non-negotiable:

- Trade Licence & Commercial Registration: A valid copy of your company's trade licence from the relevant economic department is a basic requirement.

- VAT Registration Details: Your Tax Registration Number (TRN) certificate is a key identifier.

- Bill of Entry for Imports: For any goods you’ve imported, you must provide the customs declarations (Bill of Entry). This is essential for cleanly separating international costs from local ones.

By organising everything under these three pillars, your team can build a solid, evidence-backed application that will withstand the detailed scrutiny of the ICV audit.

Getting Your ICV Certificate: The On-the-Ground Process

Alright, you've got your documents in order. Now comes the real work: navigating the official certification process. Think of this less as a compliance headache and more as a critical business project. Getting it right means treating it with focus, setting clear milestones, and keeping the lines of communication open.

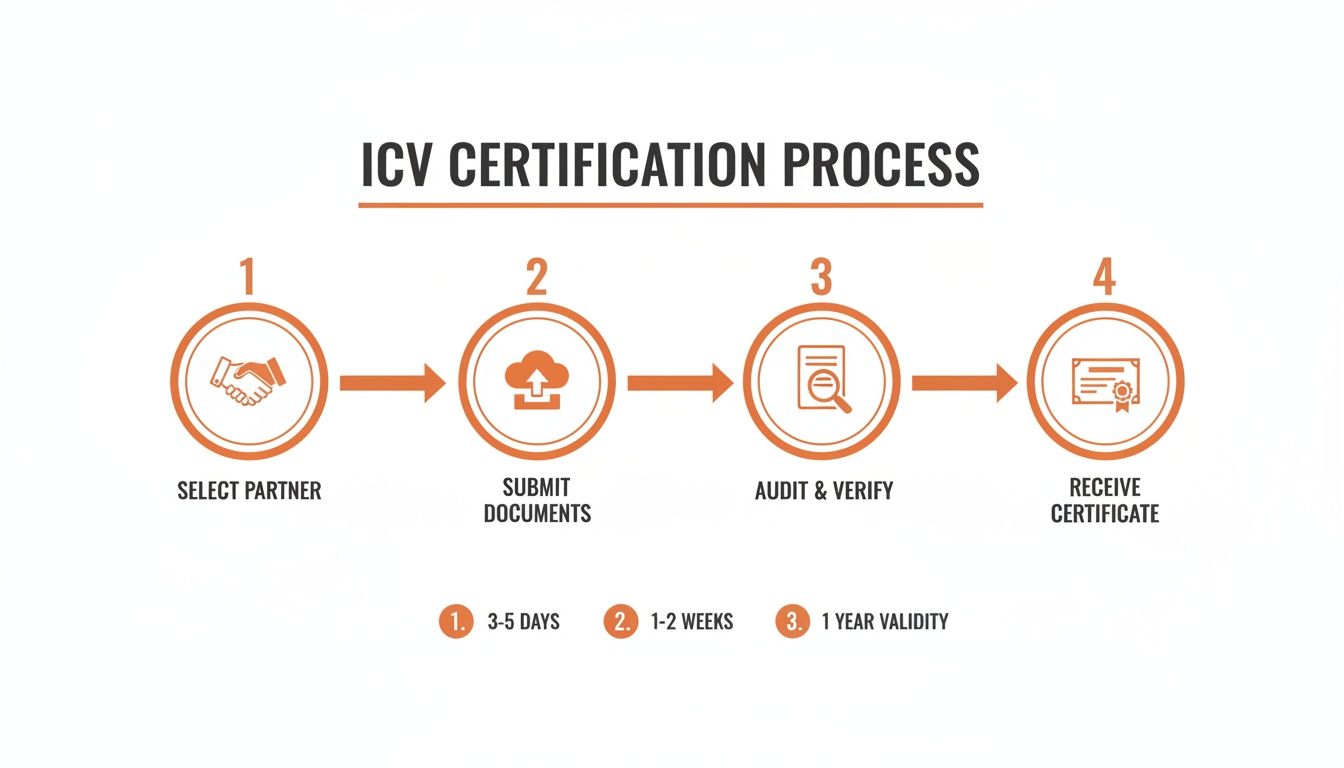

The path is pretty well-defined. You start by picking the right partner—your certifying body—then move into submitting your financials, weathering the audit, and finally, getting that all-important certificate in hand. Each step demands real precision from your finance team.

Choosing Your Certifying Body

First things first, you need to pick an ICV certifying body. And no, you can't just use your regular audit firm unless they are on the official list. The Ministry of Industry and Advanced Technology (MoIAT) has a specific list of empanelled firms that have been trained and authorised to issue these certificates.

Don't just go for the cheapest quote. A low-cost option might save you a few dirhams upfront, but if they lack experience in your sector, you could end up with a lower score or frustrating delays that cost you more in the long run.

Before you sign on the dotted line, ask some tough questions:

- Do you have experience with companies like ours? An auditor who understands your industry's cost structures and business model is worth their weight in gold.

- Who will be our day-to-day contact? You want a dedicated manager you can actually get on the phone, not a generic support email.

- What’s your real-world timeline? Knowing how long it typically takes from submission to certificate helps you plan your tenders and business development pipeline.

- Can we speak to a few of your clients? A quick chat with another business about their experience can tell you everything you need to know.

The Data Submission Gauntlet

Once you’ve appointed your certifier, they'll send you the official ICV Submission Template. This is usually a monster of an Excel file where you'll need to input your financial data, sliced and diced exactly as the ICV formula demands. This is where most of the heavy lifting happens, and there is zero room for error.

Simple mistakes here can torpedo your score. Watch out for these common slip-ups:

- Wrong Cost Categories: Misclassifying a 'Service' as 'Goods' can throw off the entire calculation. A classic example is software licence fees—those are always services, not goods.

- Mismatched Numbers: The totals in your template must tie back perfectly to your signed, audited financial statements. Any discrepancy is an immediate red flag for the auditor.

- Missing Supplier Info: If you don't include the TRN and ICV certificate details for every local supplier, you simply won't get the points for that spend. It’s a painstaking but necessary task.

My advice? Always have a second person from your finance team review the final template before it goes out the door. It's amazing what a fresh pair of eyes can catch, and those small data entry mistakes can have a surprisingly big impact on your score.

Getting Ready for the Audit

After you hit 'send' on that template, the certifying body gets to work verifying your claims. This usually involves an audit, either remote or on-site, where they'll sample transactions and ask for proof. Their job is to make sure the numbers you've declared are real and properly documented.

They will drill down into each of the ICV pillars. To verify your 'Investment' score, for instance, they might ask to see the title deed for your office or the mulkiya for company cars. For 'Emiratisation', they’ll be meticulously checking your WPS records against employee contracts and visa stamps.

Your team needs to be ready to pull up these documents quickly. One of the biggest reasons certifications get delayed is teams scrambling to find supporting evidence. Keep an open, proactive line of communication with your auditor—it builds trust and keeps things moving. Honestly, getting your financial data organised for this is great practice for the upcoming UAE e-invoicing mandate, so it’s a good opportunity to sharpen your internal processes anyway.

Your Final Certificate: The Score and What It Means

Once the audit is done and all questions are answered, you'll receive your final ICV certificate. This document will feature your official ICV score, presented as a percentage. But don't just file it away. The certifier should also provide a breakdown report showing how that score was calculated across the different pillars.

This report is pure gold. Sit down with your finance team and analyse it. Maybe you scored high on 'Third-Party Spend' but were weak on 'Investment'. This is direct, actionable feedback that should shape your strategy for the next 12 months.

And speaking of next year, remember this isn't a one-and-done deal. Your ICV certificate is only valid for 14 months from the date your audited financial statements were issued. This timeline forces you to stay current. For every renewal, you need fresh financials, updated workforce data, and proof of any new investments, all followed by a new audit. You can discover more insights about the ICV program on the MoIAT website to get a feel for their expectations. My final tip: start planning for your renewal at least three months before your current certificate expires. You’ll thank yourself later.

Common Mistakes That Can Derail Your Application

I’ve seen it happen time and time again: a company puts in weeks of effort, only to have their In-Country Value application stalled or their score torpedoed by a simple, avoidable error. The ICV process is meticulous, and even small missteps can lead to frustrating delays or, worse, an outright rejection.

Learning from the common pitfalls is the smartest way to prepare. Think of it as giving your finance team an auditor’s-eye view, helping them spot and fix problems before the application ever leaves your office. The most frequent errors almost always fall into a few key areas, particularly around how costs are classified and how financials are presented.

While this process looks straightforward, the devil is in the details. A solid grasp of what can go wrong during the submission and audit stages is what separates a smooth certification from a logistical headache.

Misclassifying Costs and Expenses

One of the easiest traps to fall into is incorrectly categorising your third-party costs. The distinction between ‘Goods’ and ‘Services’ is absolutely critical to the ICV formula, and getting it wrong will directly and negatively impact your score.

A classic example is the recurring Software-as-a-Service (SaaS) subscription for your accounting platform or CRM. It feels like a product, so many businesses instinctively list it under ‘Goods’. This is incorrect; from an ICV perspective, it’s always a ‘Service’.

Real-World Scenario: Let's say you have a recurring AED 100,000 SaaS subscription. Classifying it as 'Goods' is a mistake. It must be categorised as a 'Service'. When your provider is a local, ICV-certified entity, this correct classification ensures the expenditure is properly weighted, often giving your final score a noticeable boost.

Another trouble spot is third-party logistics. If you hire a local company to handle your shipping, those invoices are for a service—the act of transport—not for the physical goods being moved. It's a subtle but crucial distinction that requires a careful review of your expense ledger.

Financial Reporting Inconsistencies

Your audited financial statements are the foundation of your entire application. Any mismatch, no matter how small, between these statements and the data you submit in the ICV template will raise an immediate red flag and bring the audit to a grinding halt.

I often see this with companies that have multiple branches. They submit consolidated group financials when the certifying body specifically requires statements for the individual legal entity applying. This is a non-starter. Always confirm which entity's statements are needed.

From there, every number has to tie out perfectly. There is no room for rounding errors or "close enough."

- WPS vs. Financials: The total payroll you declare through the Wage Protection System (WPS) must exactly match the staff cost figures in your audited profit and loss statement.

- Supplier Payments: The total amount you’ve spent with suppliers must align perfectly with the corresponding expense lines in your financial reports.

- Asset Value: The net book value of assets in your fixed asset register must be identical to the value shown on your balance sheet.

Incomplete or Inaccurate Supplier Information

To get the maximum credit for your ‘Third-Party Spend’, you need impeccable supplier data. Simply saying you spent AED 2 million with local suppliers isn’t good enough—you have to prove it, and the proof needs to be complete.

A huge mistake is failing to provide the Tax Registration Number (TRN) for every single local supplier. Without a valid TRN, the auditor can't verify their status, and that entire chunk of expenditure could be discounted or disqualified. For a deeper dive, our guide to FTA TRN verification is a great resource.

It's also crucial to know which of your suppliers have their own ICV certificates. Spending with an ICV-certified company carries more weight in the scoring formula. If you aren't collecting and submitting your suppliers' certificates, you are literally leaving points on the table. This should be a non-negotiable part of your procurement team's vendor onboarding process.

To help your team prepare, I’ve put together this quick-reference table outlining the most frequent errors I see and, more importantly, how to sidestep them.

Common ICV Application Mistakes and Solutions

| Common Mistake | Why It's a Problem | How to Avoid It |

|---|---|---|

| Incorrect Cost Classification | Mix-ups between 'Goods' and 'Services' (e.g., SaaS) directly skew the ICV formula, lowering your score. | Review every third-party cost. Classify SaaS, logistics, and professional fees as 'Services'. When in doubt, ask your certifying body. |

| Financial Discrepancies | Mismatches between submitted data and audited financials cause immediate audit failure and significant delays. | Perform a three-way reconciliation between your ICV template, audited statements, and source systems (e.g., WPS, Asset Register) before submission. |

| Missing Supplier TRNs | Without a valid TRN for each local supplier, their spend may not count towards your ICV score. | Make TRN collection a mandatory step in your vendor onboarding process. Audit your supplier master file for completeness. |

| Not Collecting Supplier ICV Certificates | You lose out on bonus points awarded for spending with other ICV-certified businesses in the UAE. | Proactively request ICV certificates from all your key local suppliers and keep them on file. |

| Using Group Financials | Submitting consolidated statements for a single legal entity application will lead to rejection. | Always use the specific, audited financial statements for the single legal entity that is applying for the certificate. |

Treat this table as a final pre-flight checklist for your application. A thorough review against these common issues can make all the difference in achieving a smooth certification and a strong ICV score.

Beyond ICV: What Your UAE Compliance Journey Looks Like Next

Getting your ICV certificate in Dubai is a massive win. It’s official recognition of your contribution to the local economy and gives you a serious competitive edge for those big government and semi-government tenders. But what many companies don't realise at first is that the process itself is just as valuable.

Think about it. The deep dive you had to do into your company's financials—getting the scoring methodology right, pulling together all that documentation, and surviving the certifier’s scrutiny—is a fantastic stress test for your internal systems. It forces you to get your house in order. That whole exercise of cleaning up supplier records, reconciling asset registers, and ensuring payroll data is spot-on creates a powerful foundation for what's coming.

The Next Frontier: E-Invoicing

This newfound financial discipline puts you in a prime position for the UAE's next big regulatory wave: mandatory e-invoicing. The government's direction is crystal clear—digitisation is the future, and clean, structured financial data is the backbone of that entire initiative.

The skills your team honed during the ICV certification process are directly applicable here. Remember the back-and-forth to confirm supplier details? That's critical for e-invoicing, too. You can get a better sense of this by reading up on why a valid TRN number in the UAE is non-negotiable for compliance.

Ultimately, having a rock-solid system for managing financial information has moved from being just "good practice" to an absolute necessity for staying ahead of new regulations and fuelling your company's growth in the UAE.

Got Questions About the ICV Certificate? We’ve Got Answers.

When you're new to the In-Country Value program, a lot of questions can pop up. It’s completely normal. We’ve pulled together some of the most common queries we hear from finance managers and business owners in Dubai, with straightforward answers to clear things up.

Do We Really Need an ICV Certificate If We're Based in a Free Zone?

This is probably the most frequent question we get, and it's a critical one. The answer really depends on who your customers are.

If your company operates solely within its free zone, trading only with other free zone businesses or international clients, you generally don't need an ICV certificate.

But the game changes the second you want to bid for work with a mainland government department or a semi-government entity. For those tenders, an ICV certificate in Dubai is non-negotiable. Many businesses navigate this by setting up a mainland licence specifically to hold the ICV certificate and handle all government-related contracts.

How Long Will We Be Waiting for the ICV Certificate?

The timeline really comes down to one thing: how organised you are. If your paperwork is in perfect order when you submit it to the certifying body, you can expect the entire process to take anywhere from two to four weeks.

Here’s a realistic breakdown of what that looks like:

- First Look (3-5 business days): The certifier does a quick check to make sure your financials and ICV template are all there.

- The Deep Dive (1-2 weeks): This is where the real work happens. The auditors will dig into your numbers, check transactions, and almost certainly come back with questions. Your team's ability to answer these quickly and accurately is what makes or breaks the timeline.

- Final Stretch (3-5 business days): Once they have everything they need and all questions are answered, they'll calculate your final score and issue the certificate.

A Pro Tip: From our experience, nearly all delays are caused by messy documentation or taking too long to reply to the auditor's questions. A clean, well-prepared submission is your ticket to getting certified faster.

How Is the National ICV Program Different From the Old Local Ones?

Before the Ministry of Industry and Advanced Technology (MoIAT) launched the unified National ICV Program, it was a bit of a free-for-all. Big players like ADNOC had their own successful ICV program, but other government entities had similar initiatives with different rules and names. It was confusing.

The National ICV Program changed all that by creating a single, standardised benchmark.

Now, there's one unified certification process and one scoring formula that’s recognised by all participating government and semi-government bodies across the UAE. This means a single certificate, issued by any of the approved certifiers, works for tenders everywhere. It brought much-needed consistency and made it far simpler for businesses to prove their value to the local economy.

Ready to streamline your e-invoicing? Try Tadqiq today at tadqiq.ae.