The Ultimate Guide to a UAE Limited Liability Company

Discover how to set up, manage, and maintain a UAE Limited Liability Company (LLC). Your guide to formation, compliance, VAT, and e-invoicing.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

Considering a business venture in the UAE? One of the most critical initial decisions is selecting the right legal structure. For many entrepreneurs, the UAE Limited Liability Company (LLC) emerges as the premier choice, offering a powerful blend of personal asset protection and operational flexibility.

At its core, an LLC establishes a legal barrier between your personal assets and your business's financial obligations—an essential safeguard for any savvy business owner.

What Exactly Is a UAE Limited Liability Company?

A UAE Limited Liability Company is a business structure where the owners' financial risk is limited to their investment in the company. In practical terms, this creates a financial firewall. Should the business incur debt or face legal challenges, your personal assets—your home, car, and personal savings—remain protected.

This structure is ideally suited for the UAE's dynamic market, accommodating a wide range of business activities and sizes. It provides a solid, credible foundation for both small startups and large multinationals entering the region.

Key Features of a UAE LLC

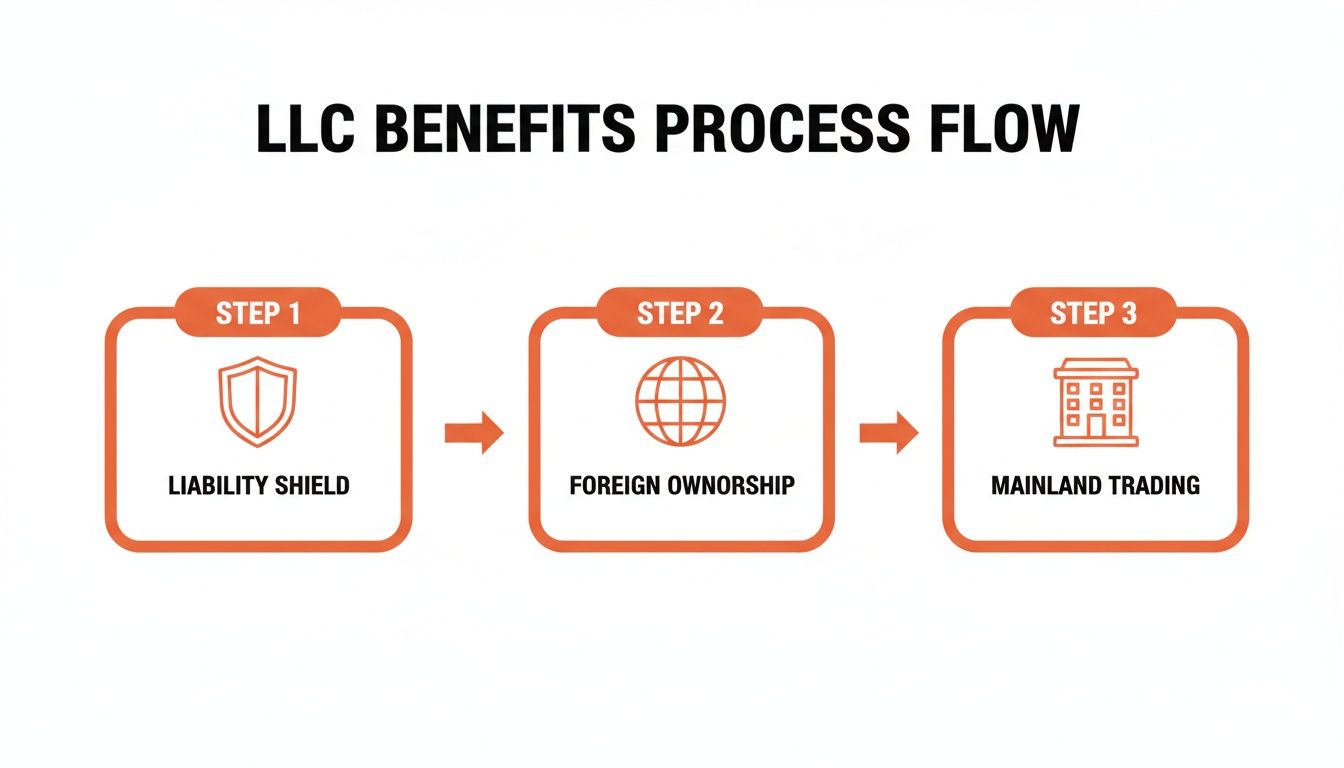

The appeal of a UAE LLC extends far beyond simple asset protection. Recent legal amendments have significantly enhanced its attractiveness for international investors. Here are the primary benefits:

- 100% Foreign Ownership: For most commercial and industrial activities on the mainland, foreign investors can now own their company outright. The previous requirement for a local Emirati partner has been largely abolished, opening the market to global entrepreneurs.

- Operational Freedom: A mainland LLC grants you the ability to trade directly with any customer or entity across the UAE and internationally without restriction.

- Enhanced Credibility: The LLC structure is universally recognized and respected. This legitimacy simplifies critical business processes, from opening a corporate bank account to securing major contracts.

The core principle of an LLC is simple yet powerful: it establishes the business as a distinct legal entity. This means the company itself—not you personally—is responsible for its financial obligations and legal commitments.

Understanding these fundamentals is the first step. Subsequent stages involve the formation process and ongoing company management. This includes crucial financial duties, such as registering for VAT and preparing for the mandatory transition to UAE e-invoicing, the new digital standard for financial compliance.

Why the LLC Is the Go-To Business Structure in the UAE

When establishing a business in the UAE, the Limited Liability Company (LLC) consistently stands out as the most popular choice. It strikes an optimal balance between protecting personal assets, providing operational freedom, and enhancing market credibility.

The key advantage is encapsulated in its name: limited liability. This structure creates a legal separation between the business and its owners. If the company faces financial distress or legal action, your personal assets are shielded from business liabilities, providing the confidence to pursue growth.

The Game Changer: 100% Foreign Ownership

Previously, foreign investors establishing a mainland business were required to have a local Emirati partner holding a 51% stake. However, recent landmark legal reforms have transformed this landscape.

Today, for most commercial and industrial activities, international entrepreneurs can hold 100% ownership of their UAE limited liability company. This change has been a significant catalyst for foreign investment, solidifying the UAE’s position as a premier global business hub and giving owners complete control over their operations and profits.

Real-World Flexibility and a Stamp of Credibility

Beyond ownership, an LLC provides practical advantages that streamline business operations. As a mainland entity, you can trade without restriction across the entire UAE market and internationally.

This structure also lends significant credibility to your enterprise, which is vital when engaging with financial institutions and other businesses.

- Easier Banking: Opening a corporate bank account is more straightforward for an LLC, as banks view it as a stable and legitimate entity.

- Winning Contracts: An LLC is perceived as a trustworthy partner, improving your prospects when bidding for government tenders or large corporate contracts.

- Sponsoring Staff: The process for obtaining employee visas is well-established for LLCs, simplifying team expansion.

The LLC dominates the UAE's business landscape because it is both robust and accessible, accommodating from one to 50 shareholders without a federally mandated minimum capital requirement. This trend has been accelerated by legal reforms, with resources like The Legal 500 tracking these developments.

A UAE LLC offers the liability protection typical of a large corporation combined with the operational simplicity of a smaller partnership, making it a perfect fit for the UAE's dynamic economy.

How to Form Your UAE Limited Liability Company

Embarking on the journey to establish a legally recognized company in the UAE is exciting, though the administrative process can seem complex. Fortunately, forming a UAE Limited Liability Company follows a structured, step-by-step procedure, primarily managed by the Department of Economic Development (DED) in your chosen emirate.

A methodical approach in these initial stages is crucial for setting your business up for long-term success.

Step 1: Nailing Down Your Business Activity and Trade Name

First, you must precisely define your business operations. The DED maintains a list of over 2,000 approved business activities, and your selection will determine your license type and may influence permissible office locations.

Next, you must choose a unique trade name that adheres to UAE regulations. This means avoiding offensive language, religious references, and names of government bodies. It is wise to prepare several options for submission and approval.

Step 2: Getting the Initial Nod and Drafting Your Legal Blueprint

With your activity and name approved, you will apply for an "Initial Approval" from the DED. This certificate is their preliminary consent to proceed with the legal formation.

Navigating this process successfully unlocks the key advantages of an LLC structure.

From personal asset protection to full access to the mainland market, these benefits are the direct payoff for getting the formation process right.

Following initial approval, you will draft the company's Memorandum of Association (MOA). This legal document details shareholder information, profit-sharing agreements, and the company's governance structure. It must be notarised by a UAE public notary. Additionally, you will need to secure a physical office space and obtain a registered tenancy contract (Ejari).

Essential Document Checklist for LLC Formation

| Document | Purpose | Key Considerations |

|---|---|---|

| Passport Copies | To identify all shareholders and the appointed manager. | Must be clear, valid, and show the visa page if the individual is a UAE resident. |

| Initial Approval Certificate | The DED's preliminary consent to form the company. | You can't proceed to the MOA stage without this document. |

| Trade Name Certificate | Official reservation of your chosen company name. | Ensure the name is unique and complies with all UAE naming conventions. |

| Notarised MOA | The legal contract outlining the company's structure and rules. | Must be signed by all partners in front of a UAE public notary. |

| Tenancy Contract (Ejari) | Proof of a registered physical office address for the business. | The contract must be registered with the Real Estate Regulatory Agency (RERA). |

Step 3: Finalising Your Licence and Getting Ready for Business

With all documents prepared, you will submit them to the DED, who will then issue a payment voucher for the trade license fee. Upon payment, you will receive your official trade license, legally permitting you to commence operations.

Several post-formation tasks are essential to become fully operational:

- Apply for an Establishment Card: This is required from the immigration authorities to begin the hiring process.

- Open a Labour File: This enables you to sponsor employee visas.

- Set up a Corporate Bank Account: A dedicated business account is essential for professional financial management.

- Register for VAT: If your annual turnover is expected to exceed the mandatory threshold of AED 375,000, you must register for VAT with the Federal Tax Authority (FTA). For a complete walkthrough, check out our guide on how to register for VAT in the UAE.

Completing these final steps ensures your new company is not only legally formed but also fully compliant and ready for business from day one.

Managing Your LLC’s Ongoing Compliance

Receiving your trade license marks the beginning of your operational journey. For a UAE Limited liability company, success depends on managing the ongoing compliance requirements that ensure business health and facilitate growth.

From the moment of incorporation, a new set of responsibilities begins. These range from administrative tasks like managing employee visas and renewing your trade license to critical financial obligations. Neglecting these duties can result in penalties and operational disruptions.

Core Operational and Financial Duties

Beyond administrative basics, your LLC has significant financial responsibilities. UAE law mandates that all companies maintain proper accounting records for at least five years. This is not merely good practice; it is a legal requirement that underpins tax compliance and financial reporting.

A primary consideration is Value Added Tax (VAT).

Key Insight: If your LLC's annual taxable supplies and imports exceed the mandatory registration threshold of AED 375,000, you are legally required to register with the Federal Tax Authority (FTA) and obtain a Tax Registration Number (TRN).

This TRN is your unique tax identifier and is fundamental to issuing proper tax invoices and filing VAT returns. Understanding the specifics of VAT in the UAE is an essential aspect of doing business here. For more details, explore our guide on what VAT is in the UAE.

Evolving Governance and Corporate Flexibility

Compliance is also about leveraging the legal framework to your advantage. Recent legal updates in the UAE have introduced greater flexibility for LLCs, enabling more sophisticated corporate structures and strategic maneuvers.

For instance, reforms now permit LLCs to transfer their registration between different emirates and free zones without dissolution, preserving their legal history and contracts. For more information, you can explore these advanced LLC regulations.

Turning Compliance into a Strategic Advantage

Staying on top of these responsibilities does more than just avoid penalties; it builds a strong operational foundation that supports growth. Key ongoing tasks include:

- Annual License Renewal: Ensure timely renewal of your trade license with the relevant economic department.

- Accurate Bookkeeping: Maintain precise and up-to-date financial records for audits, VAT filings, and informed decision-making.

- VAT Registration and Filing: Once registered, file regular VAT returns with the FTA, accurately reporting all sales and purchases.

- Corporate Governance: Keep your Memorandum of Association and other legal documents updated to reflect any changes in ownership or management.

- Visa and Labour Compliance: Maintain valid employee visas and adhere strictly to UAE labour laws.

Mastering these areas transforms compliance from a necessary chore into a strategic asset, ensuring your company is legally sound, agile, and positioned for success.

Preparing Your LLC for E-Invoicing and VAT

Once your UAE Limited Liability Company is operational, your focus must shift to financial compliance, particularly with the upcoming digital tax administration changes from the Federal Tax Authority (FTA).

The first step is Value Added Tax (VAT). If your LLC's annual turnover from taxable supplies meets or exceeds the AED 375,000 mandatory threshold, you must obtain a Tax Registration Number (TRN). This number must appear on every tax invoice and be used in all communications with the FTA.

However, VAT compliance is evolving. The UAE is preparing to implement a mandatory UAE e-invoicing system, which will fundamentally change how businesses report transactions.

Understanding the Shift to E-Invoicing

The upcoming e-invoicing mandate means an e-invoice is no longer a simple PDF. It is a structured digital file, typically in XML format, containing specific data points required by the FTA.

This initiative aims to increase transparency, reduce tax evasion, and automate tax reporting. For your LLC, this means your accounting system must generate invoices that comply with the strict technical standard known as PINT AE.

Think of PINT AE as the official digital blueprint for invoices in the UAE. As the local version of the Peppol framework, it defines the exact data structure and business rules. Non-compliant invoices will be rejected. Learn more about the timeline and technicals in our guide to the UAE e-invoicing system.

Why Data Accuracy Is Non-Negotiable

Under PINT AE, every data point on your invoice will be validated automatically. A minor error, such as an incorrect date format or a misplaced digit, can lead to the rejection of an entire batch of invoices. This can cause payment delays and potential non-compliance penalties.

The core challenge of e-invoicing isn't just technology; it's data integrity. The FTA's automated system makes pre-submission validation an essential step to ensure FTA compliance.

Common Pitfalls That Lead to Rejection

Accountants and finance managers for any UAE limited liability company must watch for these common errors that will cause an e-invoice to fail validation:

- Invalid TRN Format: The Tax Registration Number of the buyer or seller is missing, incomplete, or incorrectly formatted.

- Incorrect Date Formatting: Dates must strictly follow the YYYY-MM-DD format. Any other variation will be rejected.

- Mismatched Invoice Totals: The sum of line items plus VAT must exactly match the grand total. A discrepancy of even 0.01 AED will cause a failure.

- Invalid Currency or Unit Codes: Standardised codes must be used (e.g., "AED" for currency). Vague terms will not be accepted.

- Missing Mandatory Fields: PINT AE requires certain fields, like the invoice issue date and a unique invoice number, to be present.

These details may seem small, but automated systems will identify them every time. Training your team and updating your systems to produce clean, compliant data is essential for business continuity under the new mandate.

How Tadqiq Makes Your E-Invoicing Flawless

The new UAE e-invoicing mandate introduces strict compliance requirements where a single data error can lead to invoice rejection by the Federal Tax Authority (FTA). This can cause payment delays and significant administrative burdens.

Tadqiq simplifies this challenge. Our platform acts as a pre-submission validation engine, identifying and flagging every potential issue before your invoices reach the FTA's system. It provides a critical quality control check, ensuring every e-invoice from your UAE limited liability company is compliant on the first attempt.

A Simple Workflow for Flawless Invoices

Tadqiq is designed for busy finance teams. The process is straightforward and integrates seamlessly with your existing workflow. Simply export your invoice data from your ERP system—such as Zoho, Oracle, or Microsoft Dynamics—and upload the file to Tadqiq.

Within seconds, our platform performs a comprehensive validation against all PINT AE technical and business rules. You receive an instant, clear report that highlights any errors, enabling you to correct them proactively.

Features Built for Finance Professionals

Tadqiq is a practical tool designed to simplify compliance for accountants and finance managers. Our error messages are presented in plain English, clearly explaining the issue and its location (e.g., 'Row 15: Invalid TRN format'). This helps your team resolve problems quickly without deep technical knowledge. For more on this, see our guide on FTA TRN verification.

Tadqiq's validation extends beyond technical specifications to include all UAE-specific business rules—from correct currency codes to precise tax calculations—providing complete peace of mind.

We also cater to the unique needs of accounting firms and large enterprises:

- Multi-Client Dashboard: Accountants managing multiple LLCs can easily switch between client accounts from a single, organized interface.

- High-Volume Batch Processing: Validate thousands of invoices at once by uploading a single file, ideal for businesses with high transaction volumes.

- Complete Data Security: We prioritize your data's privacy. Tadqiq processes all information in-memory and never stores sensitive invoice content, ensuring your financial data remains secure and compliant with local data protection laws.

By identifying errors before they become costly problems, Tadqiq streamlines your FTA compliance process.

What’s Next for Your UAE LLC?

This guide has covered the key aspects of establishing and operating a UAE Limited Liability Company. The LLC structure is a popular choice due to its blend of liability protection, operational flexibility, and market credibility. You now have a roadmap covering everything from initial setup to ongoing corporate and financial duties.

Success in the UAE's dynamic market hinges on preparation and consistent compliance. The government's move towards mandatory UAE e-invoicing highlights the importance of adapting to digital regulations.

Nailing Down Your Compliance Strategy

You have learned about company formation, obtaining a TRN, and managing VAT UAE obligations. The final piece is preparing for the digital transition to the PINT AE standard, which will change how you report financial data to the Federal Tax Authority.

To ensure a smooth transition, focus on building a robust process for data accuracy:

- Get Your Team Ready: Ensure your finance team understands the strict data requirements for each e-invoice.

- Check Your Tech: Assess whether your current ERP or accounting software can export clean, compliant data.

- Validate Before You Send: Implement a pre-submission validation check to catch and fix errors before they reach the FTA, preventing rejections and delays.

Mastering financial reporting is non-negotiable. To improve your team's accuracy, start by understanding the fundamentals of how to calculate VAT in the UAE.

The Bottom Line: A successful UAE LLC is built on a solid legal foundation and flawless, ongoing compliance. The upcoming e-invoice mandate is a critical component of this, and mastering it will support your company's long-term stability and growth.

This guide provides the knowledge to navigate your business journey. The path forward involves confident decision-making, adopting digital tools to streamline FTA compliance, and focusing on building a resilient and successful enterprise.

Ready to streamline your e-invoicing? Try Tadqiq today.