Your Guide to Seamless VAT Registration UAE Compliance

A practical guide to VAT registration UAE. Learn mandatory thresholds, required documents, and how to navigate the EmaraTax portal for full FTA compliance.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

Getting your business compliant with UAE tax law is a fundamental step for any company looking to operate and grow in the region. This guide is your practical roadmap to navigating the VAT registration UAE process, cutting through the jargon to set you up for success. We'll provide a clear walkthrough to ensure you understand your obligations from the very beginning.

Navigating Your Path to UAE VAT Compliance

Proper VAT registration is the bedrock of your company's financial operations in the UAE. Completing the process correctly allows you to legally charge VAT on your sales, reclaim the input tax paid on expenses, and operate without the risk of significant penalties from the Federal Tax Authority (FTA). If you're new to the concept, our article explaining what is VAT in UAE provides a solid primer.

This guide breaks down the entire journey into manageable stages:

- Determining if you must register or if you have the option (mandatory vs. voluntary).

- Gathering all necessary documents to avoid last-minute issues.

- Completing the application on the FTA's EmaraTax platform.

Getting this right from the start is more important than ever. With major changes like the UAE e-invoicing mandate on the horizon, having your VAT house in order now will make adapting to future requirements like PINT AE far simpler.

When Does Your Business Need to Register for VAT in the UAE?

One of the first critical steps for any business is determining the right time to register for VAT. The Federal Tax Authority (FTA) outlines two paths: mandatory registration, a legal requirement once your revenue hits a certain point, and voluntary registration, a strategic choice you can make earlier. Understanding this distinction is key to maintaining FTA compliance and avoiding penalties.

A common mistake is assuming VAT only applies to large corporations. The registration thresholds can be met sooner than you think, especially for a growing business. The best practice is to proactively monitor your revenue to avoid the AED 20,000 fine for late registration.

The Mandatory Registration Threshold: When It's No Longer a Choice

You are legally required to register for VAT once the total value of your taxable supplies and imports exceeds AED 375,000. This calculation is based on a rolling 12-month period, not a calendar year, so you must constantly review the previous year's figures.

The rule also has a forward-looking component. If you anticipate your taxable turnover will cross the AED 375,000 mark in the next 30 days—for instance, after signing a major contract—you must register immediately, without waiting for the funds to arrive.

The Strategic Advantage of Voluntary Registration

If your revenue has not yet reached the mandatory threshold, you still have the option to register voluntarily. This path opens once your taxable supplies and imports (or your taxable expenses) exceed AED 187,500 in the preceding 12 months.

The primary benefit of early registration is improved cash flow. Voluntary registration allows you to reclaim the input VAT you pay on business expenses like rent, raw materials, professional fees, and equipment. That 5% adds up, and recovering it can significantly impact your bottom line.

UAE VAT Registration Thresholds at a Glance

| Registration Type | Annual Taxable Supplies & Imports | Key Consideration |

|---|---|---|

| Mandatory | Exceeds AED 375,000 | This is a legal requirement. Monitor your rolling 12-month turnover and 30-day projections. |

| Voluntary | Exceeds AED 187,500 | This is a strategic choice that allows you to reclaim input VAT on business expenses, improving cash flow. |

For many growing businesses, the financial benefit of reclaiming VAT often outweighs the administrative task of filing returns.

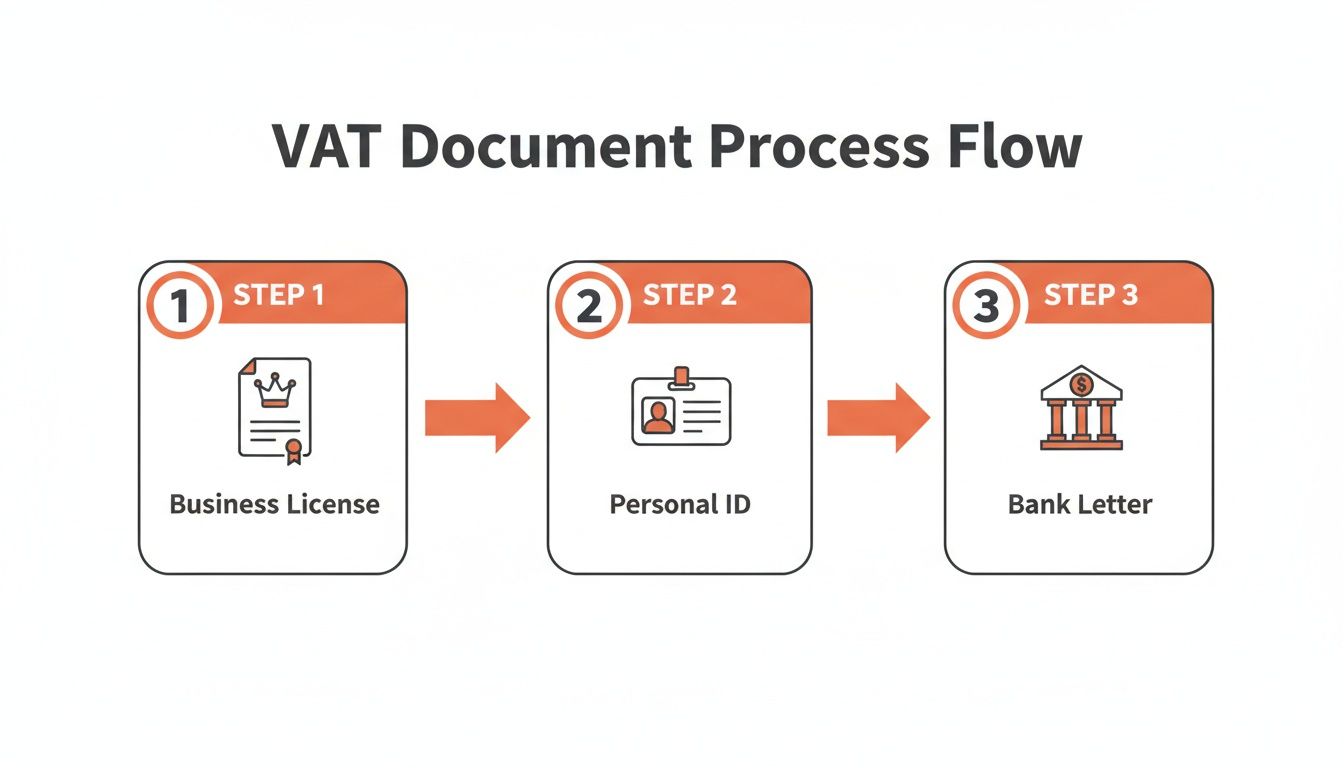

Gathering Your Essential Documents for the FTA

A successful VAT registration application depends on careful preparation. The FTA has a specific list of required documents, and even a minor error can delay your application for weeks or lead to rejection. Before logging into the EmaraTax portal, ensure you have a complete digital file of all necessary company documents.

Core Business and Personal Documents

These documents verify your business as a legitimate legal entity and identify its owners.

- A clear copy of your valid Trade Licence.

- Scanned copies of the passports for the business owner and all partners.

- Scanned copies of the Emirates ID for the owner and partners.

- Your official business contact details, including a mobile number and an email address for FTA communications.

Ensure all scans are high-resolution and that documents are current. A blurry or expired ID is a common mistake that can get your application flagged for immediate review.

Financial and Operational Paperwork

These documents provide the FTA with insight into your company's financial situation and business activities, justifying your eligibility for VAT registration.

- Bank Validation Letter: The FTA requires an official, stamped letter from your bank confirming your business account details and IBAN. A downloaded bank statement is not sufficient.

- Business Activity Description: Be specific. Instead of "Trading," use a detailed description like "General trading of consumer electronics within the UAE." This helps the FTA classify your business correctly.

Once your application is approved, the FTA will issue your unique Tax Registration Number (TRN). This number is your identity for all tax-related matters. Understanding your TRN number in the UAE is the next critical step.

A Walkthrough of the EmaraTax Online Registration

With your documents prepared, you can begin the online application on EmaraTax, the FTA's digital portal. This platform is central to the UAE tax system, handling everything from registration to filing. The FTA's efficiency is notable, with over 651,000 corporate tax registrations processed, as reported by The Finance World.

Creating Your Account and Initial Setup

First, create a user account on EmaraTax using a valid email and mobile number for verification codes and official communications. Once your account is active, you can start the VAT registration form. The initial screens will ask for basic business information, such as your trade licence details, which the system often cross-references with official databases.

Filling Out Business and Financial Details

This section requires detailed information about your company's operations, ownership, and financials.

- Business Activities: Select the most precise categories that describe your business. This informs the FTA about the nature of your taxable supplies.

- Turnover Information: Declare your revenue for the past 12 months and project your turnover for the next 30 days. These figures must be accurate and align with the mandatory or voluntary registration thresholds.

- Bank Details: Input your official business bank account information and upload the stamped bank validation letter.

Vague financial figures are a common reason for application delays. While future turnover is an estimate, it must be based on tangible evidence like signed contracts or a strong sales pipeline.

Declaration and Final Submission

The final step is the declaration, a legal statement confirming the accuracy of the information provided. Before submitting, review every field one last time to catch any typos or errors. Once submitted, your application will be in the FTA's review queue.

Upon approval, you will receive your Tax Registration Number (TRN). It is good practice to verify its validity; our guide on how to complete an FTA TRN verification can help with this.

Life After Registration: Your First VAT Return and Beyond

Receiving your TRN is just the beginning of your journey with VAT UAE. Your business is now part of the UAE's tax system, which brings ongoing compliance responsibilities. This includes maintaining meticulous records, issuing FTA-compliant invoices, and adhering to tax period deadlines.

Preparing for Your First VAT Return

Your VAT return is a calculation of the VAT you have collected versus the VAT you have paid.

- Output Tax: This is the 5% VAT you add to your sales and collect on behalf of the government.

- Input Tax: This is the 5% VAT you pay on your business purchases, which you can typically reclaim.

Subtracting your total recoverable input tax from your total output tax determines whether you owe a payment to the FTA or are due a refund. For a detailed guide, see our article on how to calculate VAT in the UAE.

Looking Ahead: The E-Invoicing Mandate

A significant regulatory shift is on the horizon. The UAE is transitioning to a fully digital tax framework, with a phased rollout of mandatory UAE e-invoicing set to begin by July 1, 2026, for all VAT-registered businesses. This new system moves FTA compliance from periodic reporting to real-time, transactional scrutiny. More details on these upcoming UAE VAT rules for 2026 on globalvatcompliance.com are available for review.

The e-invoicing mandate means every e-invoice must be structured according to the PINT AE technical standard. Standard PDF invoices will no longer be sufficient for compliance. Preparing for this transition now provides a significant strategic advantage.

Getting It Right from the Start

Successfully registering for VAT is a critical first step, establishing a solid foundation for your business's long-term tax compliance. By understanding the thresholds, preparing your documents, and familiarizing yourself with the EmaraTax portal, you can navigate the process with confidence.

However, compliance is an ongoing commitment. With the nationwide e-invoicing mandate approaching, proactive preparation is essential to avoid penalties and ensure smooth business operations. Staying ahead of these changes is the best strategy.

Ready to streamline your e-invoicing? Try Tadqiq today.