A Guide to Index Attestation UAE for E-Invoicing Success

Master Index Attestation UAE for flawless e-invoicing. Our guide explains how pre-submission validation ensures FTA compliance and avoids costly errors.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

When it comes to UAE e-invoicing, think of an index attestation as your golden ticket—it's the validation certificate that proves your e-invoice is perfectly formatted and compliant before it's officially sent. It's essentially a final quality check for your most critical financial documents, guaranteeing they’ll sail smoothly through the Federal Tax Authority's (FTA) systems. Getting this right from the start is absolutely vital for sidestepping frustrating rejections and keeping your payments on schedule.

Your Essential Pre-Flight Check for UAE E-Invoicing

Picture this: you’re about to send a high-value shipment, but you skip the final quality control check. There's a good chance it gets sent right back, leading to costly delays and a logistical nightmare. Submitting an e-invoice without proper validation is exactly like that. It’s a gamble that can easily result in a rejection from an Accredited Service Provider (ASP), throwing a wrench into your cash flow and piling on needless administrative work for your finance team.

The term index attestation UAE perfectly describes this crucial validation certificate you get after a successful pre-submission check. While it might not be an official government term, it sums up the document's role perfectly: it's tangible proof that your e-invoice aligns with the intricate PINT AE standards the FTA requires.

Why This Validation Matters

Using a validation tool like Tadqiq turns compliance from a headache into a proactive strategy. Instead of submitting an invoice and crossing your fingers, you get certainty right at the beginning. This process meticulously checks all the critical details needed for FTA compliance, making sure every single invoice you send is correct on the first try.

This pre-emptive check gives you the confidence that your invoice is solid by confirming:

- Technical Accuracy: Is the e-invoice structured correctly in the required XML format? Yes.

- Business Rule Adherence: Are all specific UAE VAT rules, like correct Tax Registration Numbers (TRNs) and date formats, properly applied? Yes.

- Submission Readiness: Is the file primed for acceptance by any ASP without triggering technical errors? Absolutely.

By generating this proof of validation, you’re not just sending an invoice; you’re building a dependable and streamlined invoicing process. If you want to get into the nitty-gritty of the mandate itself, our detailed guide on UAE e-invoicing has you covered. A little preparation now is the key to mastering the upcoming deadlines and achieving first-time submission success.

Understanding Your E-Invoice Validation Certificate

So, what exactly is an e-invoice validation certificate? It’s probably best not to think of it as just another piece of paperwork. Instead, see it as a detailed quality control report for your invoice—documented proof that it’s fully compliant before it even leaves your system. We call this an index attestation.

This certificate is your confirmation that an invoice has passed a whole series of tough checks against the official PINT AE standard. It’s your guarantee that the document is technically sound and ticks all the boxes required for UAE e-invoicing. Generating this certificate before you send the invoice out gives you a solid internal audit trail and gives your finance team the confidence that they've done their due diligence.

What Does the Certificate Actually Validate?

When a platform like Tadqiq generates your validation certificate, it's confirming the e-invoice has passed multiple, deep layers of scrutiny. This isn't just a quick once-over; it's a thorough analysis that verifies every single critical component the FTA demands.

The process boils down to three core pillars of validation:

- XML Structure (XSD Schema): This first check makes sure the technical skeleton of your e-invoice file is built correctly. It verifies that every required field is present and in the right place, which helps you avoid an immediate technical rejection from your Accredited Service Provider (ASP).

- Business Rules (Schematron): This is where the logic of your invoice gets put to the test. The validation confirms that all the sums add up, dates are in the correct sequence, and all the specific conditions for VAT UAE have been met, precisely according to the FTA’s rulebook.

- UAE-Specific Details: The final layer verifies data unique to doing business in the UAE. It checks for things like correctly formatted Tax Registration Numbers (TRNs), valid Emirati Dirham currency codes (AED), and other local must-haves for FTA compliance.

This multi-layered validation is all about catching errors early. When you can flag and fix an issue like an incorrect TRN format before submission, you save the entire invoice from being kicked back, saving a huge amount of time and administrative headache.

Getting the TRN format right is a common tripwire for many businesses. If you want to dive deeper, you can explore the specifics in our detailed guide on FTA TRN verification.

At the end of the day, the validation certificate is your documented proof that every single one of these checks was passed. It takes what could be an uncertain submission process and turns it into a predictable, controlled step in your financial workflow.

Why You Can’t Afford to "Submit and See" Anymore

In the UAE's fast-moving economy, efficiency isn't just a buzzword—it's essential for keeping your business ahead. Waiting around for an Accredited Service Provider (ASP) to reject an e-invoice is a reactive game that creates frustrating bottlenecks. It's an old-school cycle that leads to delayed payments, wastes hours on manual fixes, and even puts you at risk for non-compliance penalties.

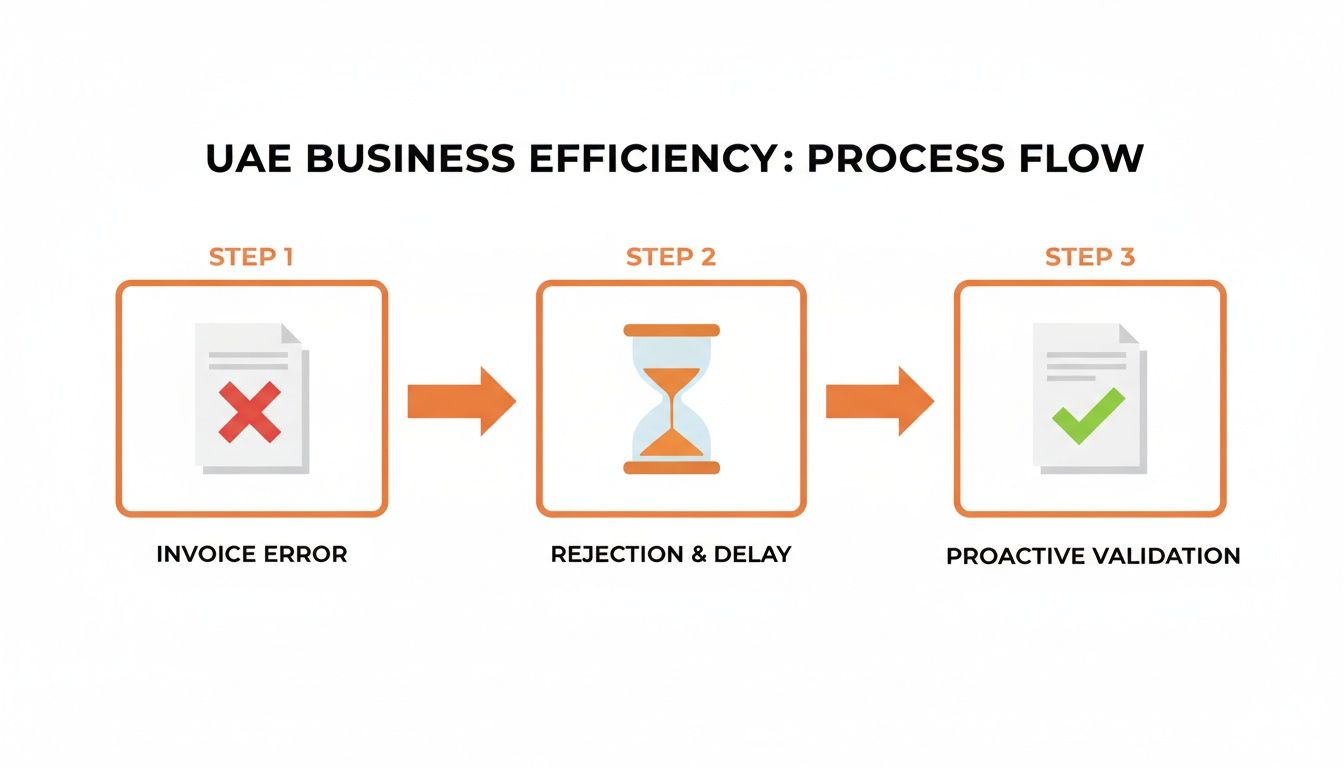

Proactive validation, which is proven by generating an index attestation, completely flips this script. Instead of putting out fires, you prevent them from starting. It turns compliance from a headache into a smooth, predictable part of your workflow, making sure your invoicing process moves as quickly as the market you're in.

The Real Cost of a Rejected Invoice

A single rejected e-invoice might not seem like a big deal, but the knock-on effects can be huge. The time your finance team spends tracking down the error, chasing other departments for the right information, and resubmitting the invoice is time they should be spending on high-value financial strategy.

Think about what really happens when an e-invoice gets rejected:

- Payments Get Held Up: A rejected invoice literally stops the payment clock. This directly hits your cash flow and messes with your revenue recognition.

- Admin Work Piles Up: Every rejection needs someone to step in and fix it manually, pulling your team away from more important work.

- It Can Strain Client Relationships: Constant invoicing mistakes can frustrate your clients and make your business look disorganised.

This reactive cycle is especially damaging in a market as competitive as the UAE. The country's dynamic financial landscape demands that finance teams operate at peak efficiency, free from the drag of preventable admin errors.

Keeping Pace with a Booming Market

The strength of the UAE's financial markets rewards businesses that are both fast and accurate. Take the MSCI United Arab Emirates Index, a key benchmark that tracks roughly 85% of the country's equity market. In 2021 alone, it delivered an incredible 50.18% return. This points to a thriving economic environment where operational drag means leaving serious money on the table. You can read more about these impressive market trends on msci.com.

For accounting firms and finance teams, this fast-paced environment makes it crystal clear: you need tools that guarantee FTA compliance without slowing down the business.

Think of pre-submission validation as your first line of defence. It ensures that every single e-invoice—whether it's one you're sending manually or part of a huge batch from an ERP like Oracle or Zoho—is flawless before it ever enters an official submission channel.

This proactive approach frees your team to focus on capitalising on market opportunities instead of troubleshooting avoidable compliance problems. Just as the UAE market has proven its resilience, your invoicing process can become just as solid, hitting PINT AE standards every single time. That’s the real value of moving from a reactive "submit and see" mindset to a proactive "validate and succeed" strategy.

How to Generate Your Index Attestation with Tadqiq

Alright, let's move from the 'what' and 'why' to the 'how'. This is where we get practical and walk through the simple process of generating your validation certificate—your index attestation—using a tool like Tadqiq. The platform was designed from the ground up for speed and simplicity, turning what could be a headache of a compliance check into a quick, three-step task.

The whole idea is to take the guesswork out of the equation. It gives your team a way to confirm an e-invoice is 100% compliant before it ever gets officially submitted.

The Three-Step Validation Process

Tadqiq's workflow is incredibly straightforward and built to slot right into your existing accounts payable process. It doesn’t matter if your team runs on Zoho, Oracle, or another ERP system; getting your compliant e-invoice and its validation certificate follows the same simple path.

- Upload Your Data: First, you just export your invoice information as a CSV, Excel sheet, or even an existing XML file. The platform can handle a single invoice or a massive batch in one go, which is a lifesaver for busy accounting firms juggling multiple clients.

- Instant PINT AE Validation: The moment your file is uploaded, Tadqiq runs it against every single PINT AE rule. The entire validation—including all the technical XSD schema and Schematron business rule checks—is usually done in less than 30 seconds.

- Receive Your Compliant File: Once the check is complete, you get a perfectly structured, compliant XML file ready to go. Alongside it, you receive your validation certificate, giving you a clear audit trail and documented proof of compliance for your records.

This simple flow represents a big shift from a reactive, error-prone system to a proactive validation workflow.

As you can see, this proactive approach is all about preventing the frustrating delays and rejections that tie up cash flow and create an administrative nightmare.

Clarity and Security at Its Core

Two principles really drive the design of Tadqiq: clarity and security. If the system flags an error, you won’t be staring at some cryptic technical code. Instead, you'll see a clear, plain-English message like ‘BR-AE-10 invalid TRN’, pinpointing the exact problem so you can fix it in seconds. For any busy finance team, that kind of direct feedback is invaluable.

Security is just as critical. Tadqiq uses RAM-only processing. In simple terms, this means your sensitive invoice data is never written to a hard drive or stored on our servers. It's processed in temporary memory and is gone for good the instant the validation is finished. This ensures you're fully compliant with the UAE’s Personal Data Protection Law (PDPL) and gives you complete peace of mind.

Built for the High-Volume UAE Market

The pace of business in the UAE is fast, and the transaction volumes are massive. The tools supporting finance teams have to be both quick and scalable to keep up.

In this kind of active environment, an accounting firm simply can't afford to be bogged down by manual invoice checks. Tadqiq was built to handle large batches efficiently, making it essential for firms that need to process thousands of invoices without ever sacrificing accuracy or speed. It brings your compliance workflow up to the pace of UAE business.

Ready to take the friction out of your e-invoicing process? You can try Tadqiq today by visiting the platform at https://tadqiq.ae.

Preventing Common Errors with E-Invoice Validation

Nothing grinds an accounts payable process to a halt faster than a rejected e-invoice. It’s a frustratingly common scenario that delays payments, creates more admin work, and disrupts your cash flow. This is where proactive validation comes in—it’s your secret weapon, catching those small but critical mistakes before they snowball into major headaches.

These errors often boil down to simple data entry mistakes, which become even more likely as UAE businesses operate on a global stage. With growing foreign investment, finance teams are juggling data from countless different systems, standards, and formats. We only need to look at the Dubai Financial Market's performance to see how diverse the ecosystem is. In 2024, for instance, the UAE market's 19.62% outperformance over other emerging markets fuelled a surge in foreign net investments. This directly translates to more cross-border transactions and a higher risk of manual error. You can dig into these trends yourself through DFM's historical data reports.

Identifying Frequent PINT AE Errors

Without running a pre-submission check, several recurring errors can easily slip through, guaranteeing your invoice gets bounced back by the system. A universal validation tool like Tadqiq acts as an instant quality check, flagging these issues right away. It doesn't matter if your data comes from Wafeq, Oracle, or a basic spreadsheet—the validator standardises it, ensuring every e-invoice is perfect before it’s even sent.

Here are a few of the most common culprits that validation tools catch:

- Incorrect TRN Format: A Tax Registration Number is frequently mistyped with spaces, dashes, or the wrong number of digits. A validator instantly confirms it follows the mandatory 15-digit structure. For a deeper dive, check out our guide to the TRN number in the UAE.

- Invalid Date Sequences: A classic mistake is putting an invoice issue date that’s before the supply date. PINT AE business rules demand a logical timeline, and a good validation tool verifies this automatically.

- Wrong Currency or Unit Codes: When dealing with international trade, it's easy to use the wrong ISO currency code (like 'USD' instead of 'AED' for a local deal) or a non-standard unit of measure.

- Mathematical Mismatches: You’d be surprised how often simple calculation mistakes between line items, VAT amounts, and the invoice total cause rejections. Validation tools run the numbers for you, ensuring everything adds up perfectly.

The table below breaks down some of these common PINT AE errors and shows exactly how a pre-flight check saves you from submission failures.

Common PINT AE E-Invoice Errors and How to Solve Them

| Error Code (Example) | Common Cause | How Tadqiq Prevents It |

|---|---|---|

BR-CO-09 | The invoice total (BT-112) doesn't match the sum of line item amounts plus charges, minus allowances. | Automatically recalculates all totals to ensure the invoice mathematically balances before submission. |

BR-AE-03 | The Tax Registration Number (TRN) in the BT-31 field does not follow the correct 15-digit format. | Scans and validates the TRN structure, flagging any non-compliant entries like spaces or incorrect lengths. |

BR-CL-04 | An incorrect ISO 6523 code is used for the buyer or seller identification scheme. | Cross-references identification codes against the official PINT AE codelists to ensure the right one is used. |

BR-S-04 | VAT breakdown per category (BT-117) doesn't equal the sum of VAT amounts on the relevant invoice lines. | Verifies that the sum of line-level VAT calculations correctly matches the summary VAT amount in the invoice header. |

By catching these issues early, you shift from a reactive, error-fixing cycle to a streamlined, efficient workflow. This proactive stance is essential for achieving first-time submission success and staying fully compliant with PINT AE standards.

Your Path to Confident E-Invoicing Compliance

So, what’s the big takeaway here? Think of an index attestation UAE as your proof of doing your homework. It’s the official nod confirming your e-invoice is perfectly aligned with the strict PINT AE specifications before it even reaches the tax authorities.

By building this simple pre-submission check into your process, you move from guesswork to certainty. It’s about more than just avoiding rejections; it’s about making sure your financial operations are smooth, accurate, and fully compliant with FTA rules.

This whole approach takes a complex obligation, like navigating the ins and outs of VAT UAE, and turns it into a straightforward, almost automatic step. Your team gets the peace of mind they need, allowing them to focus on growing the business instead of chasing down and fixing avoidable invoice errors.

For a more detailed look at the local tax framework, our guide on what VAT is in the UAE is a great place to start.

Ready to streamline your e-invoicing? Try Tadqiq today.

Frequently Asked Questions

As UAE e-invoicing gets closer, finance teams understandably have a lot of practical questions. Let's tackle some of the most common ones we hear about the process, the terminology, and how to get your team ready for FTA compliance.

Is "Index Attestation" an Official FTA Term?

That's a great question, and the short answer is no. You won't find the term 'index attestation' in any official guidance from the Federal Tax Authority (FTA).

It's actually a descriptive phrase we use for the validation certificate you get after checking your e-invoice against the PINT AE standard. Think of it as your proof of compliance—a digital receipt confirming the invoice ticks all the right boxes before it even reaches an Accredited Service Provider (ASP). When a tool like Tadqiq generates this certificate, it gives your team solid evidence that you’ve done your homework.

Do I Have to Overhaul My Company's ERP System?

Absolutely not. This is a common concern, but you can put it to rest. Standalone validation tools are designed to work with what you already have, saving you the headache and cost of a major IT project.

Whether your team uses Zoho, Wafeq, Oracle, or another system, the process is simple. Just export your invoice data into a standard CSV or Excel file and upload it. There’s no need for complex, expensive integrations, which frees up your time and budget for more important things.

How Is Our Sensitive Invoice Data Kept Secure?

We built our system with security as the top priority. Tools like Tadqiq use what's called 'privacy-by-default' architecture, which relies on RAM-only processing. In simple terms, your financial data lives only in the server's temporary memory while it's being checked.

It’s never written to a hard drive or stored anywhere permanently. The second the validation is done and the compliant XML file is created, your original data is gone for good. This method keeps you fully aligned with the UAE's Personal Data Protection Law (PDPL) and gives you peace of mind.

Can a Validation Certificate Be Useful During an FTA Audit?

Yes, it can be a really helpful part of your internal records. While the final XML file is the official document for an audit, the validation certificate acts as supporting evidence. It shows you have a thorough, proactive process for getting things right from the start.

This documentation demonstrates to auditors that your business takes its VAT UAE and e-invoicing obligations seriously. It strengthens your compliance story by proving you have controls in place to ensure accuracy before submission.

Ready to streamline your e-invoicing? Try Tadqiq today.