A Guide to the UAE Invoice Format for Seamless Compliance

Master the UAE invoice format with our expert guide. Learn PINT AE rules, mandatory fields, and FTA compliance tips for error-free e-invoicing.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

The UAE's mandatory e-invoicing system is here, transforming how businesses handle transactions. For finance managers, accountants, and business owners, mastering the new UAE invoice format is essential for ensuring FTA compliance and maintaining healthy cash flow. This guide breaks down the technical PINT AE standard into clear, practical steps to help you navigate the transition with confidence.

Understanding the UAE E-Invoicing Mandate

The shift to UAE e-invoicing is a significant change from traditional PDF invoices. The new system requires invoices to be structured data files (XML) that can be automatically validated by the Federal Tax Authority (FTA). We'll cover everything you need to know, from mandatory data fields and VAT rules to common mistakes and integration tips.

Before diving into the specifics of the format, it's crucial to understand the broader framework. Our comprehensive guide on UAE e-invoicing provides the foundational context for the technical details we cover here.

The PINT AE Standard: Core of the UAE Invoice Format

At the heart of the UAE's mandate is the PINT AE standard. This is the specific technical framework, based on the global Peppol network, that defines the exact XML structure for every B2B and B2G electronic invoice. The FTA chose this standard to enable automated, real-time compliance checks, making static PDF invoices obsolete for regulated transactions.

This new format transforms an invoice from a simple document into structured, machine-readable data. Every e-invoice must conform to the PINT AE XML format, which includes over 50 mandatory fields reported directly to the FTA. The level of detail required is precise, and getting it wrong leads to immediate rejections.

You can find more background on the UAE e-invoicing system framework on kpmg.com.

Mandatory Data Fields: A Checklist for FTA Compliance

Getting your data right is the key to successful FTA compliance. The PINT AE standard specifies a detailed list of mandatory fields that turn your invoice into a structured data file ready for automated validation. A single missing field or incorrect format can cause rejections, leading to payment delays and administrative rework.

To ensure accuracy, we've broken down the essential fields into key sections. This checklist is designed for finance professionals mapping data from ERP systems like Zoho or Oracle.

Supplier and Customer Information

- Supplier Name: The legal name of your business (e.g., "ABC General Trading LLC").

- Supplier TRN: Your valid 15-digit Tax Registration Number.

- Supplier Address: Full registered address, including city and country code (AE).

- Customer Name: The buyer's legal name.

- Customer TRN: The buyer's valid 15-digit TRN.

Core Invoice Details

- Invoice Number: A unique identifier for the transaction.

- Issue Date: The date the invoice was generated.

- Due Date: The payment deadline for the invoice.

- Invoice Currency Code: Must be "AED" for local transactions.

Line Item Details (for each product/service)

- Item Name: A clear description of the product or service.

- Quantity: The number of units sold.

- Unit Price: The price per unit, exclusive of VAT.

- Line Item Net Amount: The total amount for the line (Quantity x Unit Price).

- VAT Category Code: A specific code indicating the VAT treatment (e.g., 'S' for Standard Rate).

- VAT Rate: The applicable percentage (e.g., 5 for 5% VAT).

Invoice Totals and Tax Summary

- Total Amount (Excluding VAT): The sum of all line item net amounts.

- Total VAT Amount: The total VAT calculated for the entire invoice.

- Total Amount (Including VAT): The final amount payable by the customer.

Correctly populating these fields is the first step toward seamless UAE e-invoicing.

Getting VAT and TRN Rules Right

Incorrect VAT calculations and invalid Tax Registration Numbers (TRNs) are the most common reasons for invoice rejection by the FTA. Within the PINT AE format, every transaction must be correctly classified—whether it’s subject to the standard 5% VAT UAE, is zero-rated, or is exempt. This accuracy must be reflected at both the individual line-item level and in the invoice's overall tax summary.

The TRN is another critical point of failure. FTA business rule BR-AE-10 mandates a valid 15-digit format; any deviation results in an instant validation error. For example, an invoice between two Dubai-based businesses must include the correct, verified TRNs for both the supplier and the buyer.

To avoid these costly mistakes, learn more about the TRN number in the UAE in our detailed guide and review the official FTA TRN verification procedures in our guide.

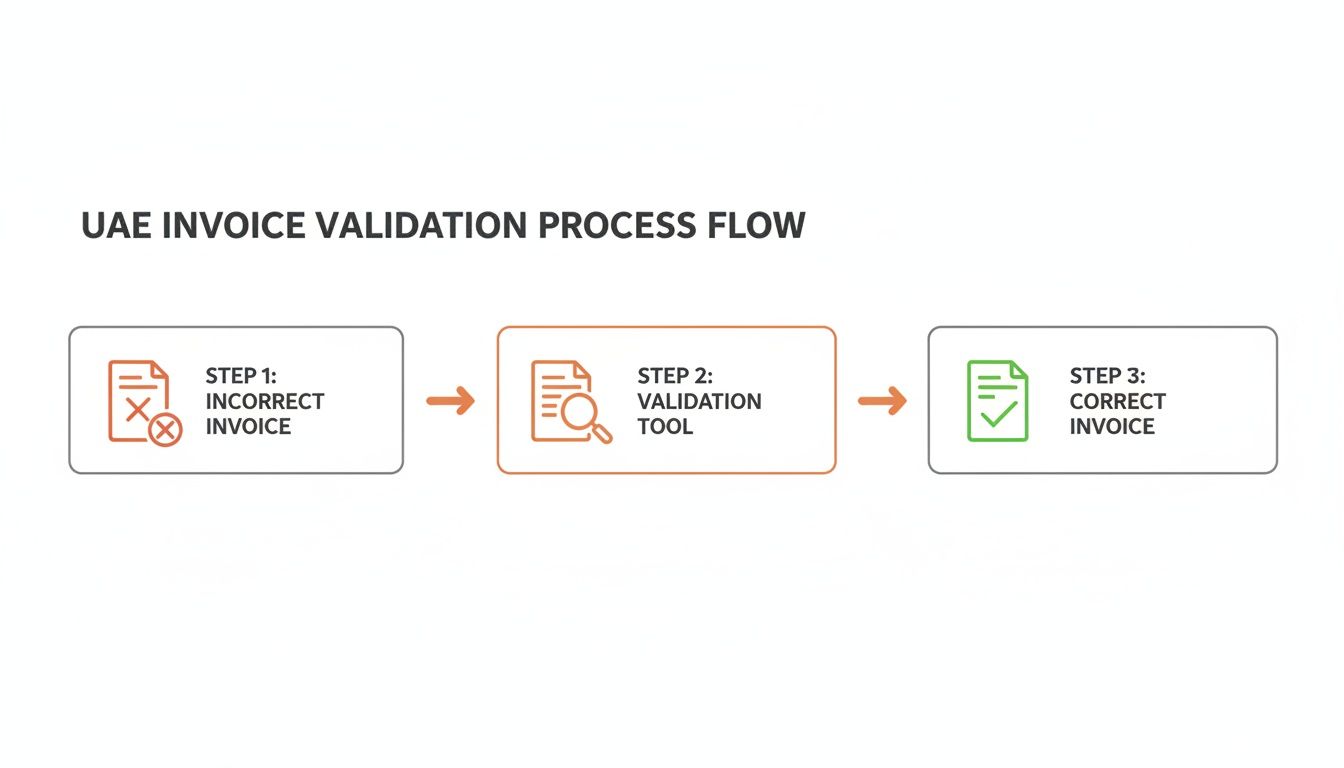

Common Validation Errors and How to Fix Them

An invoice rejection from the FTA system is more than an inconvenience—it stops your payment process cold. Understanding why these rejections happen is the first step to preventing them. Most failures are not complex; they are simple data mismatches caught by the FTA's automated validation checks.

These checks are governed by strict business rules (known as Schematron rules). When an invoice file violates a rule, the system rejects it and issues an error code explaining the problem.

Common validation errors include:

- BR-AE-10: Invalid TRN. This means the number is not 15 digits, contains a typo, or is not active in the FTA database.

- BR-CO-26: Incorrect Totals. This error occurs when the sum of the individual line item amounts does not match the overall invoice total.

- Missing Mandatory Fields: Forgetting a required field, such as the

IssueDate, will cause an immediate failure.

The best way to avoid these issues is to validate your data before submission. Using a tool like Tadqiq acts as a crucial checkpoint, allowing you to catch and fix errors upfront, ensuring a high first-time acceptance rate.

Preparing Your Business Systems for PINT AE

Generating a compliant UAE invoice starts within your own business systems. Whether you use Zoho, Wafeq, or an enterprise platform like Oracle, the first step is preparing your software for PINT AE compliance. This process relies on accurate data mapping—identifying the required data fields in your ERP and configuring them to align with the PINT AE standard.

A common approach is to create custom export templates (e.g., CSV or Excel) structured to match PINT AE requirements. This data can then be processed by an e-invoicing solution to generate the final XML file. Before exporting any data, ensure your business is correctly set up for tax obligations. Our guide on how to register for VAT in the UAE is a great place to start.

UAE E-Invoicing Deadlines You Can't Ignore

Meeting the UAE’s e-invoicing deadlines is critical for avoiding penalties and business disruption. The rollout is phased to manage the transition smoothly for businesses of all sizes.

- 1 July 2026: A voluntary pilot phase begins, allowing early adopters to test and prepare their systems.

- 31 July 2026: The deadline for large businesses (annual turnover > AED 50 million) to appoint their Accredited Service Provider (ASP).

- 1 January 2027: Mandatory compliance begins for this first wave of large businesses.

- 31 March 2027: Smaller businesses must have their ASP onboarded.

- 1 July 2027: Full compliance becomes mandatory for all remaining businesses.

You can find the official cabinet decision and further timeline details at RTCSuite.com.

Final Thoughts: Mastering E-Invoicing in the UAE

Mastering the new UAE invoice format is essential for smooth financial operations. By understanding the PINT AE standard, preparing your data carefully, and using tools to validate it before submission, you can avoid common errors and ensure timely payments. A key part of this process is accurate tax calculation; for a refresher, see our guide on how to calculate VAT in the UAE.

By tackling this transition proactively, you can turn a compliance requirement into a competitive advantage for your business.

Ready to streamline your e-invoicing? Try Tadqiq today.

FAQ: Your Questions on the UAE Invoice Format Answered

As businesses adapt to the new e-invoicing system, several common questions arise. Here are straightforward answers to help you navigate the changes.

What is the difference between a PDF and a PINT AE e-invoice?

A PDF invoice is a digital image of a document, designed for humans to read. A computer cannot easily extract and process its data without manual entry. In contrast, a PINT AE e-invoice is a structured XML data file built for machines. Every piece of information—invoice number, date, VAT amount—is tagged, allowing the FTA’s systems to automatically read and validate it. This machine-to-machine process eliminates manual work and is the foundation of the UAE e-invoicing mandate.

Do I need to replace my current accounting software?

Likely not. Most modern accounting and ERP systems, from Zoho to Oracle, can export transaction data into a standard format like CSV. The key task is mapping the fields from your software’s export to the required fields of the PINT AE standard. An intermediary platform like Tadqiq can then convert this data into a compliant XML file, simplifying FTA compliance without requiring a costly system overhaul.

What happens if my e-invoice is rejected?

A rejected invoice has no legal standing and will halt the payment process. Rejection occurs if the e-invoice fails validation by your service provider or the FTA. Common reasons include an invalid TRN, incorrect VAT calculations, missing mandatory fields, or mathematical errors in the totals. Using a pre-validation tool to check your UAE invoice format before submission is the best way to catch these issues, ensure a high acceptance rate, and keep your cash flow moving.

Ready to make your e-invoicing process foolproof? Tadqiq is built to ensure your invoices are compliant from day one. Try Tadqiq today.