A Practical Guide to the UAE VAT Invoice Format for PINT AE

Master the UAE VAT invoice format for PINT AE. Our guide explains mandatory fields, common errors, and FTA e-invoicing compliance for UAE businesses.

Posted by

Related Reading

A Practical Guide to E-Invoicing in the UAE

Master e invoicing in UAE. This guide breaks down the PINT AE standard, FTA compliance deadlines, and how to prepare your business for the 2026 mandate.

Read →

A Practical Guide to HS Codes for Dubai Customs & E-Invoicing Compliance

Discover hs codes dubai customs and learn how accurate classifications speed up UAE trade, FTAs, and customs clearance.

Read →

A Guide to TRN Verification FTA for UAE E-Invoicing

Master TRN verification FTA for UAE e-invoicing. Our guide covers manual checks, APIs, and batch validation to ensure VAT compliance and avoid penalties.

Read →

Getting your UAE VAT invoice format right isn't just about good bookkeeping anymore—it's a non-negotiable part of doing business here. An incorrect invoice can do more than just cause a headache; it can lead to rejected payments, operational gridlock, and even attract penalties from the Federal Tax Authority (FTA). This has become especially urgent as the country gears up for mandatory UAE e-invoicing.

Why Your Invoice Format Is Now Mission-Critical

For a long time, businesses in the UAE treated invoices as documents for people. As long as a person could read it and find the key details, it worked. But the game is changing. The upcoming shift to the PINT AE standard is turning your invoice from a simple document into a structured data file built for machines to read.

This single change makes every field on your invoice incredibly important. Under the new system, an invoice won't just be glanced at by an accountant. It will be automatically validated by software against a very strict set of FTA rules. A tiny error—like a Tax Registration Number (TRN) in the wrong place or an incorrectly formatted date—can get your invoice instantly rejected.

Thinking digital-first about your UAE VAT invoice format is now essential for a few very practical reasons:

- Stay on the Right Side of the FTA: The new mandate demands precise, machine-readable data. Nailing the format is your first line of defence against compliance problems.

- Keep Your Cash Flow Healthy: Rejected invoices stop the payment process in its tracks. That means delays in getting your money.

- Make Your Finance Team's Life Easier: When the process is standardised and correct from the start, your team spends less time fixing and re-sending invoices and more time on what matters.

Think of this guide as your roadmap for navigating these changes. We'll break down exactly what goes into a compliant invoice, helping you get ready for the future of VAT in the UAE. If you need a refresher on the basics, our detailed explanation of what VAT is in the UAE is a great place to start.

This image really gets to the heart of the challenge businesses are facing: how to bridge the gap between old-school paperwork and new-school digital compliance. Making this transition smoothly is what will separate the businesses that struggle from those that thrive in the UAE's modern tax landscape.

A Field-by-Field Guide to Building a Compliant UAE VAT Invoice

Think of your VAT invoice as a formal conversation with the Federal Tax Authority (FTA). Each field tells a piece of the story, and if you leave something out, the entire document can be questioned. This can cause frustrating payment delays or, worse, compliance headaches down the road. Let’s walk through exactly what you need to build a perfect UAE VAT invoice.

Whether you’re issuing a full or a simplified tax invoice, some details are completely non-negotiable. Getting these foundational elements right is the first step towards ensuring your documents meet the FTA’s standards.

Core Invoice Information

This is the "who, what, and when" of your transaction. These details need to be crystal clear and easy to spot on every single invoice you send out.

- Explicit Title: The document must be clearly labelled “Tax Invoice” right at the top. This leaves no room for confusion about its purpose.

- Sequential Invoice Number: Every invoice needs a unique number that follows a logical sequence. It’s essential for tracking and prevents messy duplicates, which is a lifesaver during an audit.

- Date of Issue: This is simply the date you generate the invoice.

- Date of Supply: If it’s different from the invoice date, this is the official date the goods were delivered or the services were completed.

Since VAT was introduced on 1 January 2018, the law has been clear. Businesses are required to issue a tax invoice within 14 days of the supply date. This deadline makes timely and accurate invoicing a critical part of your operations. For a deeper dive, you can always refer to the official VAT guidelines on the Ministry of Finance website.

Supplier and Recipient Details

Clearly identifying both parties is fundamental. Missing or incorrect information here is one of the top reasons invoices get rejected, particularly in B2B transactions.

Supplier (Your Business) Information:

- Your full legal name and address.

- Your Tax Registration Number (TRN).

Recipient (Your Customer) Information:

- Their full legal name and address.

- Their TRN, but only if they are registered for VAT in the UAE.

A missing or invalid TRN on a B2B invoice is an almost guaranteed failure in any automated e-invoicing system. Always double-check you have the correct TRN for every registered business customer. If you want to learn more about this crucial identifier, check out our complete guide on the TRN number in the UAE and how to verify it.

Financial Breakdown and VAT Calculation

Now for the numbers. This is where precision is absolutely paramount, as sloppy calculations are a huge red flag for the FTA. Every financial detail needs to be broken down with total transparency.

Here’s what you need for each line item:

- Line Item Description: A clear explanation of each good or service you provided.

- Unit Price: The price per item, before adding VAT.

- Quantity: How many units you supplied.

- Tax Rate: The specific VAT rate for that item (e.g., 5% or 0%).

- Amount Payable (Excluding VAT): The subtotal for that line item, in AED.

Finally, the invoice needs a clear summary of the grand totals. This means showing the total net amount (before tax), the total VAT amount calculated at 5%, and the final gross amount payable. All these figures must be clearly stated in AED.

If you happen to conduct a transaction in a foreign currency, you have an extra step. You must convert the VAT amount back to AED using the UAE Central Bank’s official exchange rate for the date of supply. It’s this level of detail that separates a compliant invoice from a problematic one.

Understanding the Shift to PINT AE E-Invoicing

The way businesses in the UAE handle invoices is about to change, and it’s a big one. For years, we’ve thought of an invoice as a document for human eyes—a PDF or a piece of paper. The upcoming mandatory e-invoicing system flips that on its head. It’s no longer about creating a readable document; it’s about generating structured, machine-readable data.

At the heart of this change is PINT AE, the UAE's specific e-invoicing standard. Sending a traditional PDF invoice is like posting a letter. Someone has to open it, read it, and manually key the information into their accounting system. Sending a PINT AE e-invoice, on the other hand, is like sending a secure, perfectly formatted data package. The recipient's system—and crucially, the FTA's—can instantly read and validate every single detail without anyone lifting a finger.

This shift means the rules are getting much stricter. The new UAE e-invoicing framework is built for automated validation, which leaves absolutely no room for the small ambiguities or errors we might have gotten away with in the past.

What Is PINT AE and Why Does It Matter?

PINT AE stands for Peppol International – UAE Extension. Peppol is a globally recognised set of standards that lets businesses exchange electronic documents, like invoices, over a super secure network. The UAE has taken this proven framework and tailored it to its own tax requirements, creating what we now know as the PINT AE standard.

This standard dictates the exact structure and format for every electronic invoice. It’s not just about what information you include, but how you include it. Every piece of data, from the invoice date to the VAT amount, has a specific home in a structured XML file. This guarantees consistency and allows any compliant software to process it seamlessly and automatically.

For finance managers and accountants, this is a major operational shift. The focus is no longer on invoice design but on data accuracy and structure. Your accounting software must be capable of generating an export that can be perfectly converted into this XML format—a process that needs careful data mapping and validation. You can learn more about the specifics in our deep dive into UAE e-invoicing.

The End of the Simplified Invoice

One of the biggest impacts of the PINT AE mandate will be the end of the simplified tax invoice for most B2B and many B2C transactions. This is a critical point for many businesses, especially those in retail, that have long relied on these less detailed documents.

The UAE's move to mandatory e-invoicing will kick off in July 2026. This transition to structured, machine-readable XML formats essentially makes the simplified invoice obsolete for businesses covered by the mandate. The new framework demands 15-20+ mandatory data elements, a massive leap from the 8-10 fields on a typical simplified invoice.

This expansion of required fields is the FTA sending a clear message: data completeness is now non-negotiable for FTA compliance.

Preparing for the 2026 Deadline

July 2026 might sound like it’s a long way off, but the groundwork for this transition needs to start now. Moving to a new invoicing system isn't like flipping a switch; it involves multiple stages that require serious time and planning.

The PINT AE mandate is more than a technical upgrade—it's a process overhaul. Businesses that wait until the last minute risk significant operational disruption, payment delays, and non-compliance penalties. Early preparation is the key to a smooth transition.

Here’s a quick rundown of why you need to get moving sooner rather than later:

- System Assessment: You have to figure out if your current ERP or accounting software can even produce the data exports you’ll need.

- Data Cleansing: All your existing data—customer TRNs, addresses, item codes—must be clean and accurate to pass the new automated checks.

- Process Redesign: Your accounts payable and receivable workflows will have to be completely re-thought to handle structured e-invoices.

- Partner Integration: You’ll need to connect with an Accredited Service Provider (ASP) who will transmit your e-invoices to the FTA's system.

By starting now, you give your team the breathing room to understand the requirements, test your systems, and make sure your business is ready. The goal is a smooth transition that maintains business continuity and ensures you are fully compliant with the FTA from day one.

How to Avoid Common VAT Invoice Errors

Even the sharpest finance teams can slip up on an invoice. In the world of automated validation, a small mistake can create a big problem. Under the upcoming PINT AE system, an incorrect invoice isn't just a document that needs a quick correction—it's a data file that gets instantly rejected. That means payments grind to a halt and your team is left with avoidable clean-up work.

By building a solid quality check process now, you can catch these issues before they become compliance nightmares, saving a ton of time and preventing costly delays down the road.

Invalid Tax Registration Numbers (TRN)

The Tax Registration Number (TRN) is arguably the single most important piece of information on any B2B tax invoice. A missing, incomplete, or flat-out wrong TRN is an immediate red flag for any validation system.

We see the same TRN mistakes pop up time and again:

- Simple Typos: One wrong digit is all it takes to cause a mismatch.

- Outdated Information: A customer might deregister for VAT, but their old TRN is still sitting in your system.

- Incorrect Placement: Shoving the TRN into a general "notes" field is a common error. If it’s not in the designated data field, it won't be mapped correctly into the e-invoice XML file.

A quick check to confirm all TRNs are 15 digits long and match your verified customer records before an invoice is even created is a great habit. Proactively verifying your customers' TRNs against the official FTA database eliminates one of the most frequent reasons for invoice rejection and keeps your data clean from the start.

Incorrect VAT Calculations and Rounding

The UAE’s standard VAT rate is a straightforward 5%, but calculation errors are surprisingly common. The FTA has very precise requirements for how VAT is calculated and displayed, and an automated system will spot any deviation instantly.

Here are the key areas to watch:

- Calculating on the Gross Amount: A classic mistake. VAT should always be calculated on the net (pre-tax) amount.

- Rounding Errors: The FTA requires that VAT fractions be mathematically rounded to the nearest fil for each line item, not just on the final total.

- Applying the Wrong Rate: Slapping the 5% rate on zero-rated or exempt supplies is another frequent error.

For a complete breakdown of the correct methods, have a look at our detailed guide on how to calculate VAT in the UAE, which walks through different scenarios with clear examples.

Formatting and Code Mismatches

With the shift to PINT AE, the format of your data is just as important as the data itself. The system needs specific, internationally recognised codes for things like currency and units of measure. Using familiar abbreviations instead of the official ISO codes will lead to an immediate validation failure.

This is a new kind of error that many businesses aren't used to checking for yet.

- Currency Code: Many systems still use "AED" for the UAE Dirham. However, the PINT AE standard demands the official ISO 4217 currency code, which is simply AE.

- Date Formats: To be machine-readable, invoices must use the

YYYY-MM-DDformat. Common formats likeDD/MM/YYYYwill be rejected. - Unit Codes: Vague descriptions like "box" or "piece" just won't cut it anymore. You have to use standardised UN/CEFACT codes, such as "PCE" for a piece or "BX" for a box.

These might seem like small technical details, but they are absolutely essential for achieving FTA compliance in a structured data world. Making sure your ERP or accounting software is configured to output these specific codes is a critical step in preparing for the UAE e-invoicing mandate.

Using Pre-Validation to Guarantee Compliance

Pushing invoices straight from your ERP system into the official tax portal can feel like a high-stakes gamble. A single, tiny mistake—a typo in a TRN, a wrong date format—can get an entire batch of invoices bounced right back. This sends your finance team scrambling to find the needle in the haystack, causing delays and piling on unnecessary stress.

Thankfully, there’s a much smarter, safer way to handle this. It’s all about adding a pre-validation workflow, a critical quality check that sits between your system and the government's gateway. This simple step transforms the process from a risky bet into a guaranteed success.

The Power of a Quality Checkpoint

Think of a pre-validation service like Tadqiq as your compliance safety net. Instead of sending your data directly into the official system and just hoping for the best, you first run it through a controlled environment. Here, your invoice data is meticulously checked against the very same official PINT AE validation rules the tax authority uses.

This intermediate step is the secret to hitting a 100% success rate with every single submission. It’s designed to systematically find and flag every potential error before it can cause a real headache.

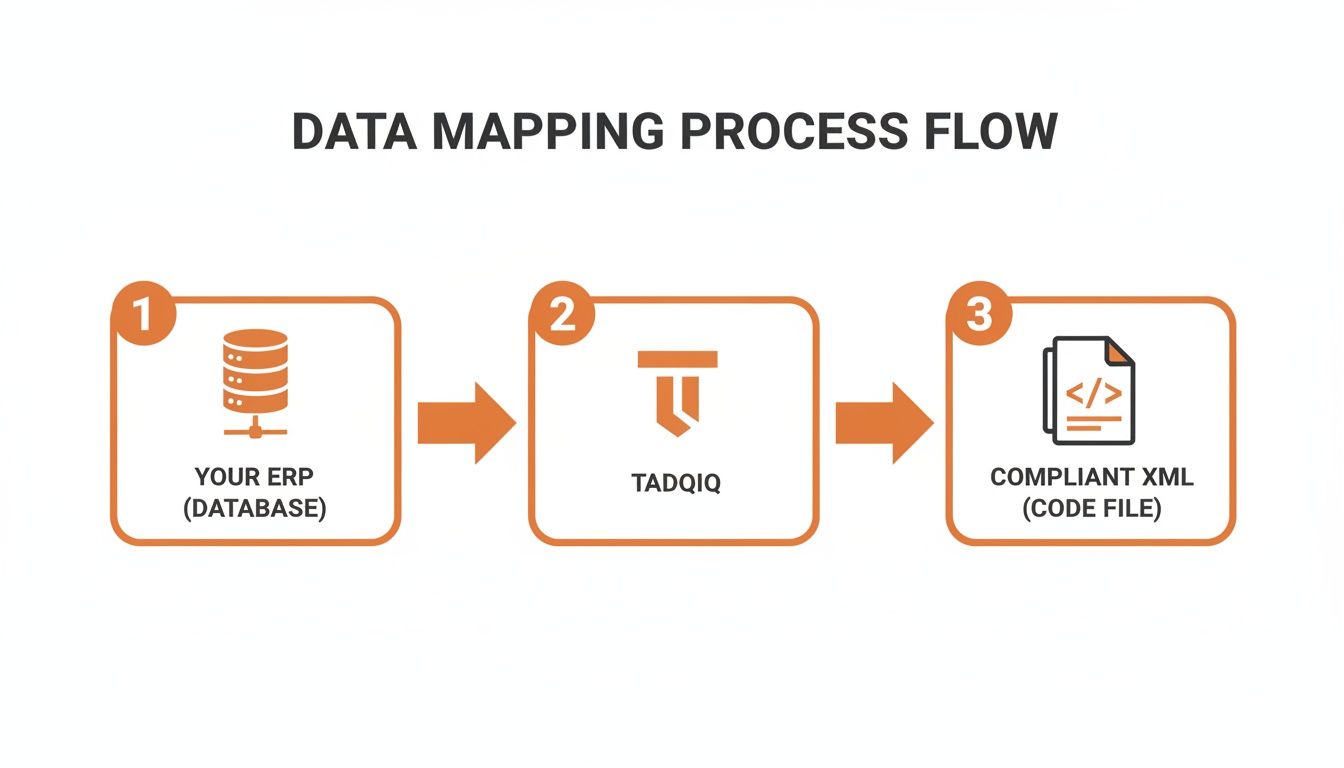

This diagram illustrates how data flows from your system, through a pre-validation step, and emerges as a perfectly compliant file.

As you can see, the pre-validation platform acts as a smart converter. It takes the raw data, refines it, and produces a perfectly structured XML file that’s ready for FTA compliance.

Catching Errors in a Controlled Environment

The true beauty of pre-validation lies in the clear, actionable feedback it provides. When an error is spotted, the system tells you exactly what’s wrong, in plain English, and points you to the specific row and field that needs attention.

Some of the most common issues are caught instantly:

- Invalid TRNs: The platform confirms every Tax Registration Number is correctly formatted and active. Our deep dive on FTA TRN verification explains just how crucial this check is.

- Incorrect Date Formats: It makes sure all dates strictly follow the required

YYYY-MM-DDstructure. - Mismatched Currency Codes: It verifies you're using the official ISO code 'AE', not the common but incorrect 'AED'.

- Calculation Mistakes: The system re-calculates all VAT totals and line items to ensure they are spot-on and follow the correct rounding rules.

With this kind of organised feedback, your team can fix every issue in one go. No more frustrating cycles of submit, reject, fix, and resubmit.

Generating Guaranteed-to-Pass XML Files

Once you’ve cleared all the flagged errors in the pre-validation environment, you can generate a clean, perfectly structured PINT AE XML file. This isn't a file that should pass; it's a file that is guaranteed to pass the official checks because it's already been vetted against the exact same rulebook.

By separating validation from submission, you remove all the guesswork from your e-invoicing process. You get total control, ensuring every e-invoice you issue is right the first time, every time. This approach brings peace of mind, shifting the entire process from reactive firefighting to proactive quality control, making the transition to the UAE e-invoicing mandate smooth, predictable, and stress-free.

Conclusion

Navigating the UAE's shift to mandatory e-invoicing requires a focus on data accuracy and structure. Understanding the key fields of a compliant VAT invoice, from TRNs to correct VAT calculations, is the first step. By embracing tools that offer pre-validation, businesses can eliminate common errors, guarantee FTA compliance, and ensure a smooth transition to the PINT AE standard.

Ready to streamline your e-invoicing? Try Tadqiq today at tadqiq.ae.